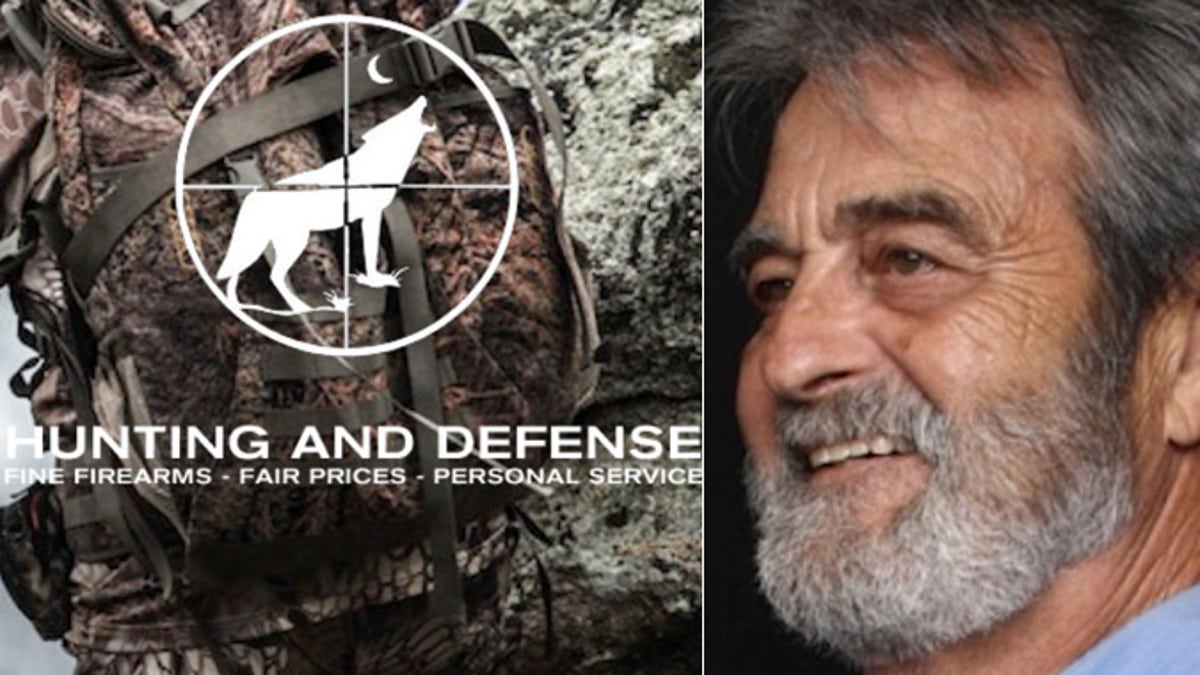

Luke Lichterman, (r.), said HomeTrust Bank denied services to his web-based business, citing federal regulations.

A North Carolina gun seller won a duel with his local bank, after the lender denied his web-based business its services, erroneously citing a controversial banking regulation, he told FoxNews.com Thursday.

For months, Luke Lichterman had tried to get his Hometrust Bank branch to process purchases, but officials told him a 2013 Department of Justice regulation dubbed “Operation Choke Point” barred them from serving a “risky” business, he said.

"When I asked the bank representative what other businesses are considered 'risky,' the first word out of his mouth was 'pornography,’” Lichterman, who is 75 and disabled from a serious car accident, told FoxNews.com. “I was both deeply offended and highly amused by that.”

Lichterman’s online store, http://www.huntinganddefense.com, takes digital payments, but without his bank’s help he would have been forced to used costly transaction services that would have taken a huge bite out of his already-thin profit margins, he said.

"I was aware of Operation Choke Point and that it was intended to make it impossible for people with a fraudulent business to do banking,” Lichterman said. “But I sell firearms, which is constitutionally protected, and am licensed by the federal government to sell firearms.”

Fortunately for Lichterman, after several discussions with bank officials, some negative publicity and pressure from Second Amendment advocacy groups, the bank reversed its position.

"The pressure brought by groups like the Second Amendment Foundation against 'Operation Choke Point' and financial institutions who were intimidated by the Obama administration has resulted in not only exposing the attack on the lawful firearms industry but has forced many banks to back off this attack on a constitutionally protected right," said Alan Gottlieb, founder of the Second Amendment Foundation.

Lichterman can now use a check processing service that costs him 10 cents per transaction rather than a credit card service that charges 4.5 percent.

Kelsey Harkness, a journalist with The Daily Signal who broke the story on the controversial DOJ program’s impact on firearms dealers, said despite the Obama administration’s repeated attempts to keep Operation Choke Point under wraps, Americans continue to find out about it when legally-operating small business owners are caught in the crossfire.

“The only reason Luke Lichterman was able to get his account back was because he went public with his story — it makes you wonder how many other innocent business owners are being victimized by this secretive government program without even knowing it," Harkness said.

Other types of businesses impacted by the 2013 banking regulation, Harkness reported, include coins and bullion dealers, ammunition dealers, credit repair services, dating services, fireworks sales, money transfer networks and tobacco sales.

Critics say the program is misguided and heavy-handed and has coerced third-party financial institutions into cutting off funds and credit to businesses that are legal but may not be politically favored.

That has caused those businesses to seek funds at higher rates from less well-established sources or go out of business altogether, said John Malcolm, director of the Edwin Meese III Center for Legal and Judicial Studies and the Ed Gilbertson and Sherry Lindberg Gilbertson Senior Legal Fellow for The Heritage Foundation.

“The greatest impact, of course, will be felt by small business owners, who will have to scratch and claw to survive,” Malcolm said. “If fraud is what the government wants to stop, then it should investigate and target practices that are actually fraudulent, not practices it finds legal-but-distasteful.”

A spokesperson contacted from HomeTrust Bank in Asheville, N.C., did not return a call from FoxNews.com. Neither did officials at the Justice Department.