May 03, 2024

Coming up on Monday, May 6 edition of ‘Special Report’

Shannon Bream gives you a sneak peek at the next show.

Latest Videos

Full Episodes

May 03, 2024

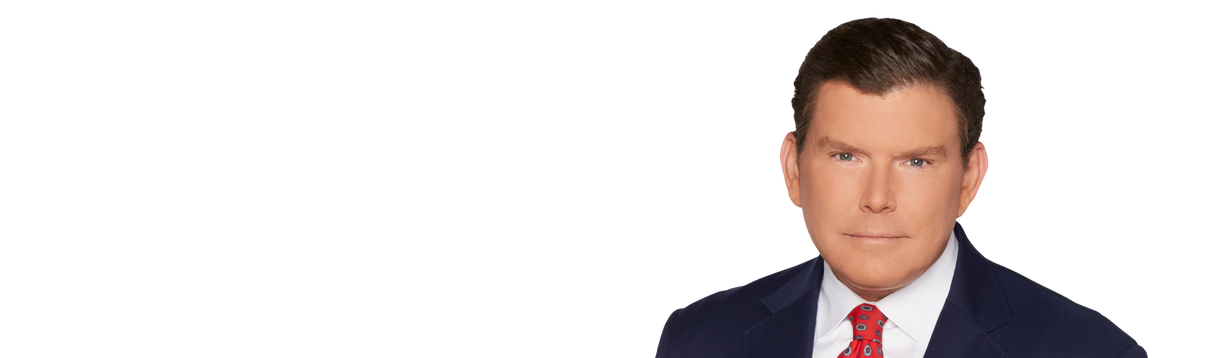

Special Report w/ Bret Baier - Friday, May 3

May 02, 2024

Special Report w/ Bret Baier - Thursday, May 2

May 01, 2024

Special Report w/ Bret Baier - Wednesday, May 1

April 30, 2024

Special Report w/ Bret Baier - Tuesday, April 30

April 29, 2024