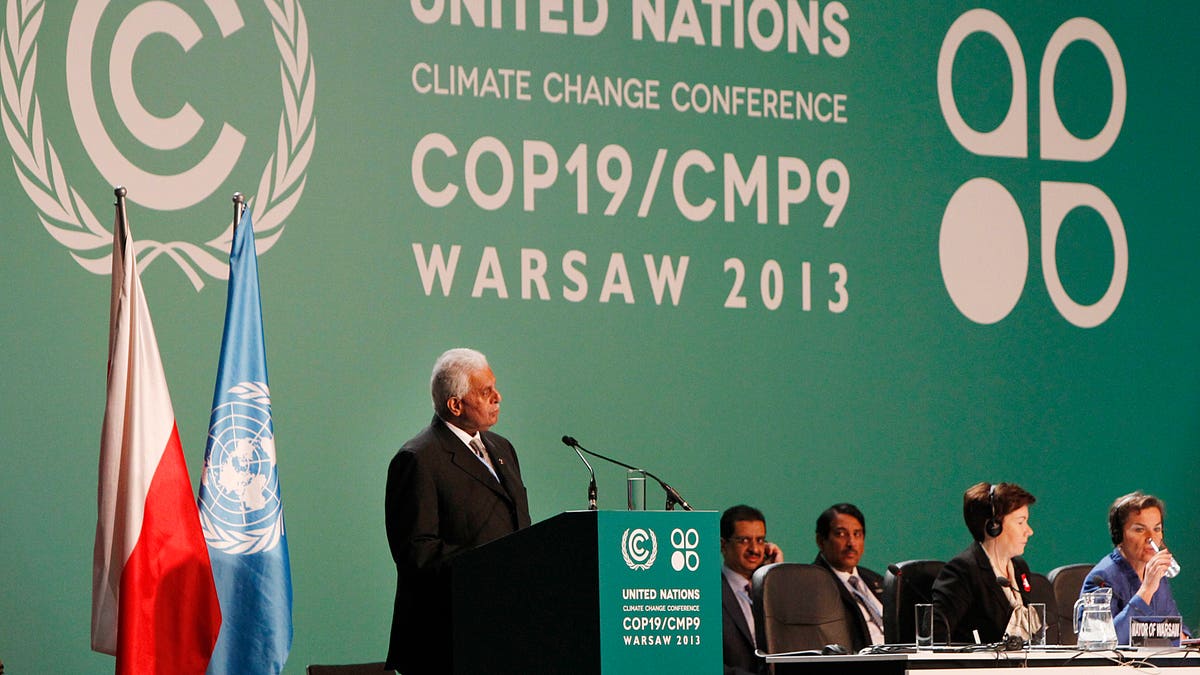

Qatar's Abdullah Bin Hamad Al-Attiyah,left, President of previous COP18 ( Conference of Parties) addresses delegates during the opening session of the United Nations Climate Change Conference COP19 in Warsaw, Poland, Monday, Nov. 11, 2013. Thousands of participants from nations and environment organizations from around the world have opened two weeks of U.N. climate talks that are to lay the groundwork for a new pact to prevent global warming. (AP Photo/Czarek Sokolowski) (AP2013)

EXCLUSIVE: The United Nations-administered cap-and-trade system for reducing greenhouse gases is sitting on a cash hoard of close to $200 million, even as it warns of hard times ahead that could impede its mission.

The cash cushion for the Geneva-based organization known as the Clean Development Mechanism, or CDM, amounts to more than 400 percent of the $45 million reserve that it considers a normal set-aside for rainy days, according to its recently published business plan for 2014-2015.

Given the organization’s projected belt-tightening budget of about $33 million for next year, it also means the CDM’s more than 170 employees could, theoretically, do absolutely nothing for the next six years before they would have to go out of business.

The CDM’s intention, of course, is to do the opposite: it is preparing to suffer through a lean year or two and counting on 194 nations that assembled in Warsaw, Poland, this week, to successfully kick off negotiations intended to lead to a new global climate control treaty for signing in 2015 -- and, the organization hopes, a new and even bigger gusher of cash.

[pullquote]

That treaty would go into effect in 2020 and, its proponents hope, include the U.S., the biggest hold-out to the Kyoto Protocol, which ended the first phase of its existence last year -- the source of the CDM’s bonanza. It is now tottering with reduced international support through its “second commitment period,” which lasts, not coincidentally, until 2020.

If the new, drawn-out treaty process is a success -- a big question mark, even with the strong backing of, among others, the Obama administration -- the CDM hopes to do at least as much carbon-trading business -- and possibly four times as much -- over the five years from 2015 to 2020 as it did after it kicked into high gear in 2004, due to the increased “level of ambition” (translation: steeper mandated cuts in global carbon emissions) that proponents want to see embedded in the new accord.

CLICK HERE FOR THE BUSINESS PLAN

At the moment, however, the CDM is watching sign-ups for its projects plummet, facing reduced numbers of customers for the tradable carbon emission reduction certificates (CERs) that result, and trying hard to come up with new lines of business, especially for African countries that were largely left out of the gusher of carbon-reduction investment of the previous decade.

According to a couple of sentences in a draft version of a CDM report to the Kyoto treaty parties gathered in Warsaw -- toned down in the final version -- the “serious decline” in the CDM’s momentum is a “grave concern” to the CDM’s supervisory executive board, “and should be a grave concern of [Protocol] parties and all stakeholders that have invested their time and resources to build the CDM.” The CDM, as the final version of the report has it, “is at risk.”

The boom-bust cycle of the CDM -- the world’s largest single source of carbon-trading certificates -- is a rough parallel to the history of the Kyoto Protocol itself. The Protocol was signed by virtually every country in the world in 1990 -- the U.S. signed, but never ratified -- but fizzled last year, capped by the withdrawal of Canada. Nearly a dozen other countries have warned that they may follow suit, or at least fail to add to their original commitments to cut carbon emissions.

For its part, the U.S., though not a party to the Protocol, has stuck by a commitment to cut national carbon emissions by 17 percent from 2005 levels by 2020, and the Obama administration is intent on expanding that commitment further in outlying years. White House websites still invoke the overall aim of the U.N.-sponsored climate change treaty process of lowering carbon emissions by 80 percent by 2050.

For the CDM, those commitments can translate into a hefty cash flow. It essentially acts as a middleman in the process of creating projects in developing countries, paid for by participants in developed countries, that are calculated by its vetted experts -- predominately a host of European and Asians consulting and technical contractors -- to provide certified reductions in carbon emissions.

CLICK HERE FOR A LIST OF CDM CONTRACTORS

As part of the same middleman role, the CDM sits at the center of a much bigger array of consultancies and other service providers that create and sustain its project inventory.

CLICK HERE FOR THE SERVICE PROVIDER LIST

CERs, each representing a metric ton of reduced carbon dioxide equivalent, can be issued once the verification process has been completed. These can be traded, and counted against carbon reduction commitments for Kyoto participants. They can also be used, to some degree, to offset carbon and other taxes in Europe.

According to its annual report to the Kyoto treaty parties, the CDM has created 7,293 projects, issued more than 1.38 billion CERs so far, and “stands ready to further contribute through the crediting of a further 1.4 to 6.2 billion emission reductions by 2020.”

Less well known is the fact that the CDM takes a fee for every CER that it issues -- worth $0.10 for each of the first 15,000 tons, and $0.20 for every ton thereafter, “to assist with the administrative expenses of the executive board and other bodies involved in the Protocol framework.”

To judge from the size of the CDM surplus, the “share of proceeds” has clearly done a lot more than that. But even in 2013 -- when the number of projects registered by the CDM has dropped to about 80 percent from the previous year, fees and “share of proceeds” is expected to bring in $35 million, or just less than the CDM’s $38 million budget. The difference will hardly make a dimple in the organization’s current cash trove.

The bigger worry is that the CDM’s reputation has been tarnished in the past, both by its bureaucratic ponderousness, and by some of the questionable greenhouse gas emission strategies it has fostered.

A December 2011 report to the European Commission described the CDM as “costly, unpredictable, unreliable, prone to gaming,” and “counter-productive due to perverse incentives.”

An analysis of CDM “green” projects at that time revealed that more than 70 percent of the investment had gone to China and India and many of the biggest were devoted to destruction of a potent greenhouse gas known as HFC-23, considered more than 11,000 times more potent than carbon dioxide.

Making HFC-23 is relatively cheap, meaning that the rewards for destroying it can create huge incentives to manufacture more of it -- a “perverse incentive” that the European Commission tried to end by banning the acceptance of CERs based on HFC-23 destruction as of 2013.

The banning decision, as it happens, coincides to a large degree with the roughly 85 percent decline in newly submitted CDM projects this year. (Part of that huge decline was due to an equally large spike in projects in 2012, aimed at getting them registered before the European Commission deadline took effect.)

Faced with these and other criticisms, the CDM claims to have gone far to clean up its act. Only about 53 percent of its most recent projects are in Asia, the organization reports, and long-ignored Africa gets nearly 28 percent. New schemes have been pulled together that allow small-scale projects to be bundled as “programs of activities” into bigger allotments, making them more attractive for investment.

But nothing so far has given the CDM relief from its biggest problem, a colossal overhang of CERs that were generated years ago, by the collapse of the moribund, high-polluting post-Communist industries of eastern Europe, and which, along with the European restrictions, have created a huge glut on the CDM carbon market.

As a result, CERS are currently trading at about $0.50 each -- which in turn, means that the CDM “share of proceeds” for emitting new ones amounts to a punitive 40 percent.

What will truly save the CDM is a huge spurt in demand for its emission reduction certificates --in other words, a new “level of ambition” in greenhouse gas emission cuts as a result of the new round of Kyoto talks.

It is far from clear at this stage that those reductions, in the context of a new treaty, will take place. But it is already clear that the Obama administration, for one, intends to have a vigorous hand in trying to make it happen.

In a submission to the Warsaw meeting about the forthcoming 2015 treaty negotiation process, the State Department called for a draft version of each nation’s carbon reduction commitments be ready by “early 2015,” in anticipation of a further “consultative process” – negotiations --prior to agreement.

“For its part, the United States is working now to analyze its opportunities for reducing emissions post-2020,” the document says. “We would encourage other parties to do likewise.”

In the administration’s vision of the treaty process, each country would be encouraged to put forward its own “ambitious” commitments for the future, and “will need to be prepared to justify its commitment to the world”—a process intended, apparently, to encourage bigger cutbacks.

Not all elements of such a package need be percentage reductions; some could be such things as “research and development investments,” or commitment to a -- presumably high -- price for carbon emissions.

According to the U.S. submission, “a goal of this process is to encourage what we’ve called a ‘race to the top’ -- that is, a dynamic in which parties are both comfortable with putting their best commitment forward, and uncomfortable about not putting their best effort forward, because they want others to see they are contributing the most they can to solve the climate problem.”

Over at the CDM, one imagines, they want to see the parties to the post-Kyoto negotiations do the very same thing.

George Russell is editor-at-large of Fox News and can be found on Twitter @GeorgeRussell