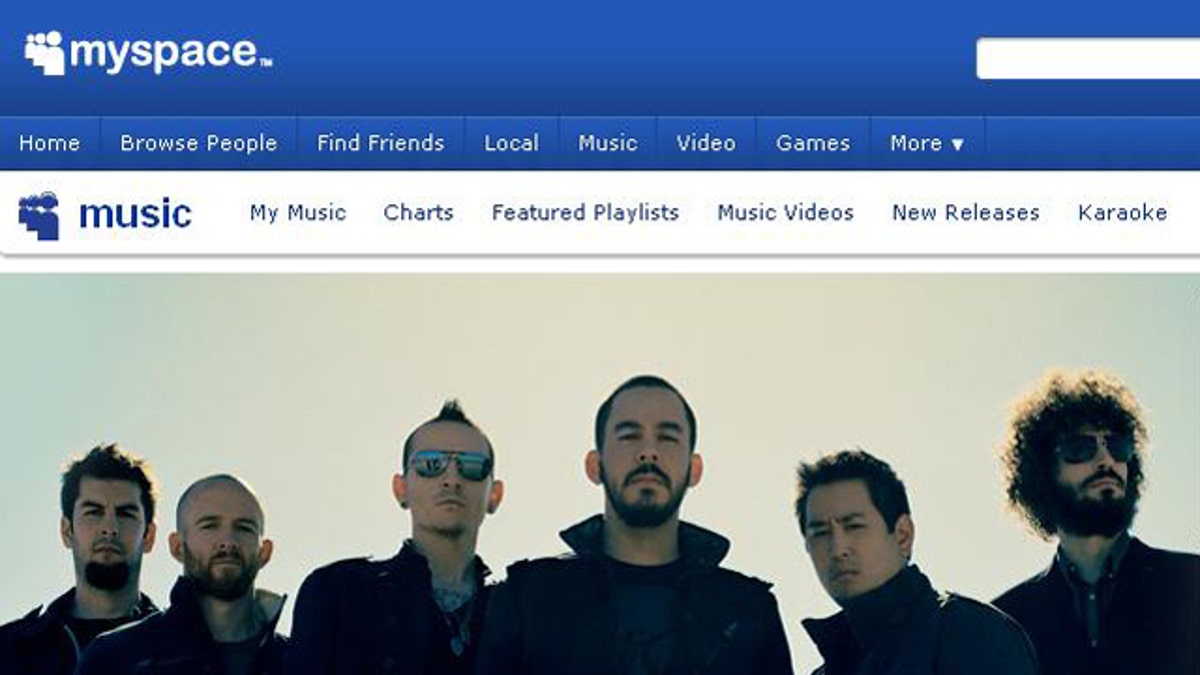

A screen capture of the MySpace Web site. (MySpace.com)

SAN FRANCISCO – New low-paying and lesser-known buyers are competing to buy Myspace for between $20 million and $30 million, sources said Tuesday.

As part of the deal, the ailing News Corp. unit would make significant cuts in staff and costs -- up to 50 percent or more -- as part of the sale to Specific Media or Golden Gate Capital, AllThingsD.com reported Tuesday.

News Corp., which also owns FoxNews.com and NewsCore, might retain a small minority stake. It hopes to complete the deal by Thursday, its fiscal year end.

Specific, a large advertising network, was in the lead, sources said.

Golden Gate Capital is a private equity firm with $9 billion under management, which has mostly specialized in turning around companies. It has never invested in a consumer internet company.

Both companies, sources said, will focus Myspace on music, although it was not clear which rights the site has with music labels will transfer to a new owner.

Until last week, the preferred deal for Myspace centered on an investor group that included Activision CEO Bobby Kotick and in which News Corp. would retain a large minority ownership stake.

But sources said there were some transactional and legal complexities that made it less attractive, and News Corp. opened up the deal talks with others again last week.