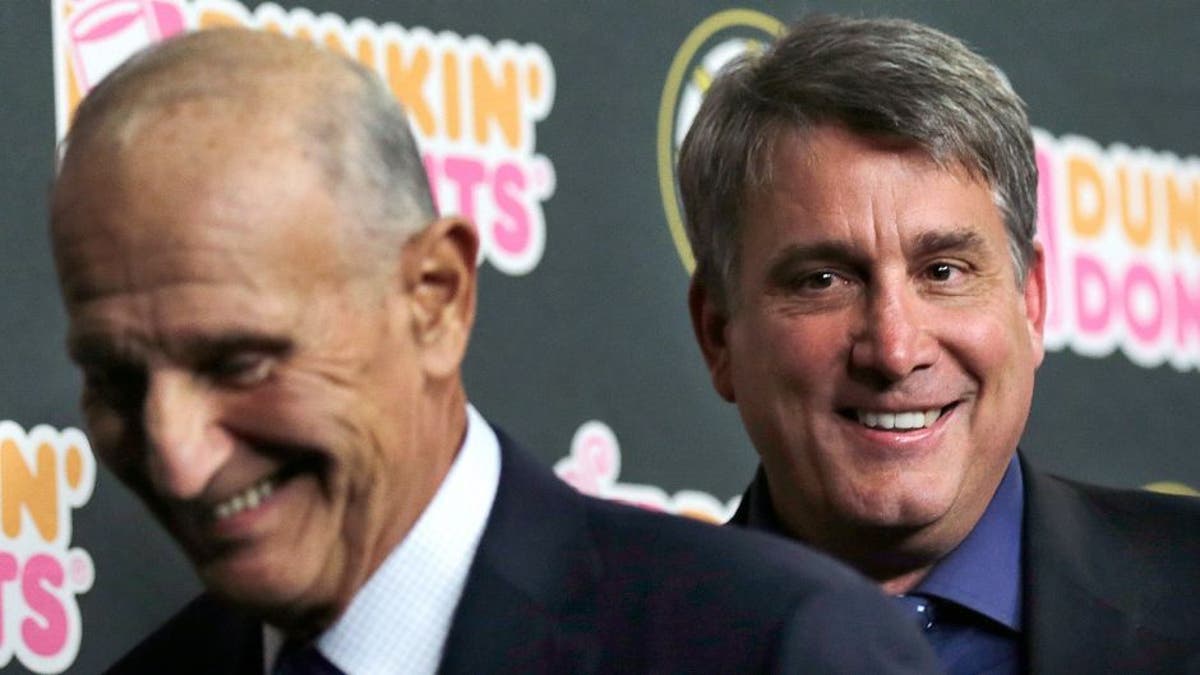

Boston Bruins president Cam Neely, right, smiles as leaves with team owner Jeremy Jacobs after a news conference in Boston, Tuesday, May 20, 2014. The Bruins were eliminated from the NHL hockey playoffs by the Montreal Canadiens. (AP Photo/Charles Krupa)

The Bruins might have a case of the hungry horrors, as a recent report claimed the team is in a battle with the IRS over the cost of feeding a team of professional athletes.

The Boston Globe reported that the team received a notice in April from the IRS saying the Bruins owe $85,028 in taxes from 2009-10. The Bruins reportedly filed an appeal in July saying they don't owe that money because that was the amount of a 100 percent tax deduction for team meals during road trips.

Bloomberg BNA reported that normally, there is a limit of a 50 percent deduction for meal expenses, but the Bruins are arguing that the 50 percent limit does not apply in their case because feeding their players is something which is fundamental to their business. An attorney for the Bruins declined to comment on the case to the Globe.

According to the Globe, other Boston teams provided a mixed report on their pre-game meal policies. The Red Sox make players pay for their clubhouse meals while the Celtics refused to comment on their policy and the Patriots did not respond.

The case creates an interesting debate, however, as to whether team-provided nutrition is an integral part of sports business in the current world. It seems both sports fans and the IRS will be interested in the outcome of this appeal.

(h/t The Boston Globe)