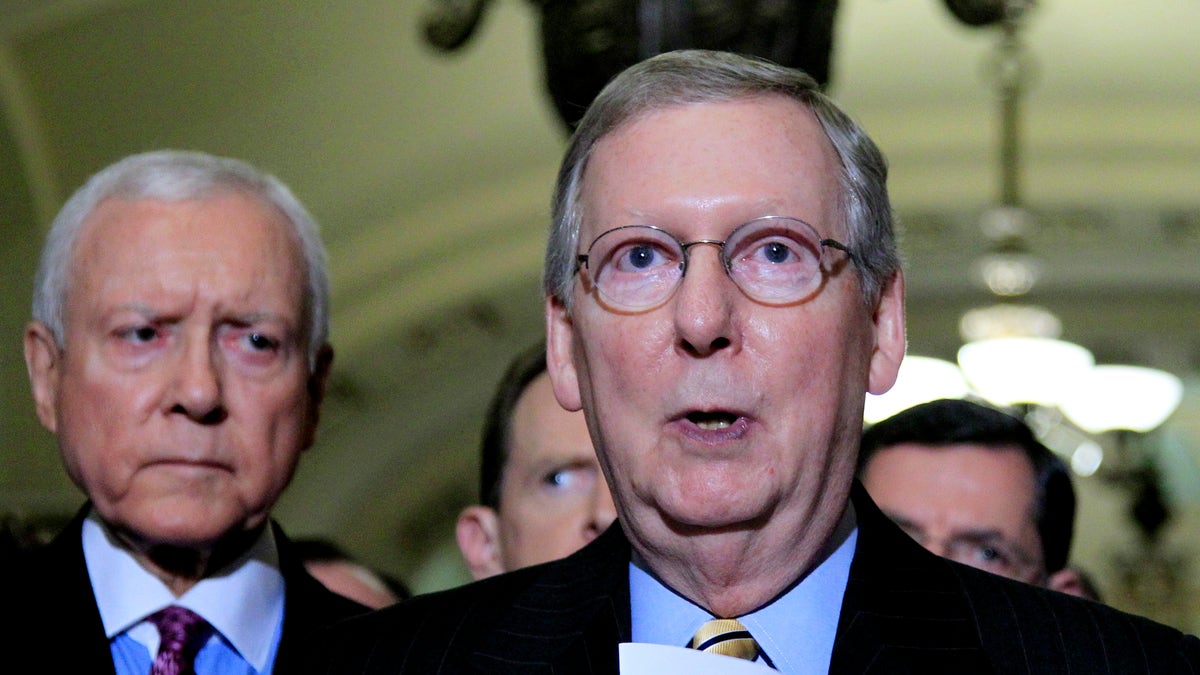

Senate Minority Leader Mitch McConnell, R-Ky. speaks to reporters on Capitol Hill in Washington, Wednesday, June 29, 2011. (AP2011)

Democrats are targeting $126 million in tax write-offs for the horse-racing industry that they say amount to a "Bluegrass Boondoggle" offered up by Senate Minority Leader Mitch McConnell in the 2008 farm bill.

McConnell, the Kentucky Republican whose state is home to one of the nation's most prestigious horse auctions, sponsored an amendment to the farm bill that allows horse owners to write off their fillies in shorter than the normal seven-year window. Democrats say the cost to taxpayers amounts to $126 million over 10 years in additional give-backs.

"When it comes to these programs, there must be no sacred cows and there must be no sacred horses," said Sen. Jeff Merkley, D-Ore. "Horse racing may have been called sport of kings, but that doesn't mean they deserve royal treatment ... while working families don't get a chance to compete."

On Thursday, Sen. Dick Durbin, D-Ill, the No. 2 Democrat in the Senate, professed his love for horses and the race tracks.

"But to think we're going to subsidize them at the expense of Medicaid recipients? The poorest children in America? Makes no sense," he said.

The latest coordinated attack -- which hits on yacht owners, as well as thoroughbreds -- is part of a Democratic strategy to paint Republicans as guardians of the rich as the two sides wrangle over the terms to raise the nation's debt ceiling before a possible default Aug. 2.

Republicans are opposed to any tax increases as part of a deal to increase the $14.3 trillion debt limit, which was reached in May. They argue it would harm the fragile economic recovery. But Democrats say tax hikes on the highest-earning Americans must accompany trillions in spending cuts proposed by Republicans.

With 9.2 million horses in the U.S. and 2 million horse owners, horse racing has emerged as a major pastime in America. According to the American Horse Council Foundation, which commissioned a study in 2005, 4.6 million Americans are involved in the horse industry, which has a $39 billion annual direct economic effect on the U.S. economy. The industry pays $1.9 billion in taxes each year to all levels of government, the foundation says.

Racehorseowners.com notes that the amount bet on the Breeders Cup alone exceeds $120 million each year. The group said states administer the tracks, with the tracks taking about 20 to 25 percent of the handling fees to pay taxes and expenses.

The attack on horse racing came one day after President Obama rebuked Republican lawmakers in a news conference, suggested that by opposing high-end tax increases they are looking out for America's elite -- corporate jet owners, "millionaires and billionaires" and others who can afford luxuries middle American can't.

Sen. Charles Schumer, D-N.Y., said Thursday picked up that theme Thursday, saying that the deduction for boat owners who keep their vessels in a dock slip is the "most egregious of tax expenditures."

"As long as your yacht has a place to sleep and, how shall I put it, a place to relieve yourself, you can claim as a second home and claim mortgage interest deduction," he said, noting that the only IRS requirement is to provide proof that the owner spent 14 days on the boat during the tax year.

"If only Gilligan and the Skipper had taken a 14-day trip, they could have expensed the SS Minnow," he joked.

But any attempt to raise revenue on the backs of boat owners would yield minimal results. Wendy Larimer, the U.S. legislative coordinator for the Association of Marina Industries, said about 5,600 yacht owners qualified for the deduction last year, and of that number, less than 5 percent took advantage of the offer.

A senior McConnell aide also pointed out that Schumer may not want to press removal of the horse write-off. While horse racing is big in the Bluegrass State, home to the Kentucky Derby, there's plenty of horsing around in the Empire State as well.

New York is home to tracks at Saratoga, Aqueduct and Belmont, among other places, and breeders work throughout the state. Saratoga is the other big auction house other than Lexington.

Fox News' Trish Turner contributed to this report.