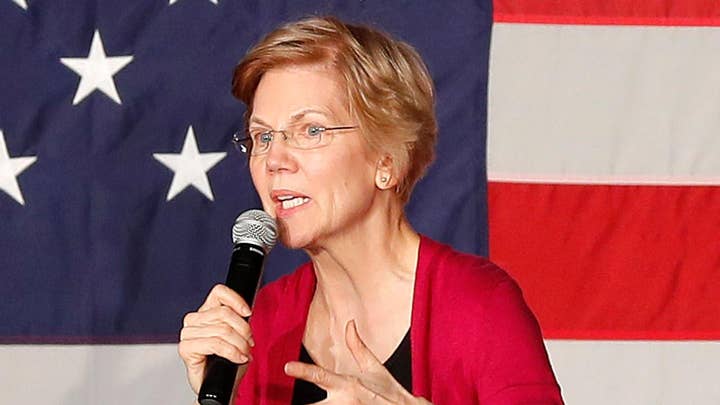

2020 presidential hopeful Sen. Elizabeth Warren, D-Mass., is proposing a new “wealth tax” on Americans with more than $50 million in assets, as well as other measures that include a significant hike in funding for the Internal Revenue Service.

"We need structural change. That’s why I’m proposing something brand new – an annual tax on the wealth of the richest Americans. I’m calling it the 'Ultra-Millionaire Tax' & it applies to that tippy top 0.1% – those with a net worth of over $50M," Warren, who sits on the left of her party, tweeted Thursday afternoon.

The Washington Post reported the proposal involves a 2-percent wealth tax on those with more than $50 million in assets, and an additional 3 percent on those with more than $1 billion.

ELIZABETH WARREN GIVES TRUMP THE SILENT TREATMENT AS 2020 CAMPAIGN KICKS OFF

Economist Emmanuel Saez, one of two left-leaning economists at the University of California, Berkeley, who advised her on the proposal, claimed it would raise $2.75 trillion over 10 years.

Warren also tweeted: "The rich & powerful run Washington. Here’s one benefit they wrote for themselves: After making a killing from the economy they’ve rigged, they don't pay taxes on that accumulated wealth. It’s a system that’s rigged for the top if I ever saw one."

Such a proposal is not out of character for Warren, who has long railed against income inequality and the uber-rich, but would mark a move to the left by the party as a whole if it were adopted. Democrats have been nervous about pitching higher taxes, although a number have said they would reverse some of President Trump’s 2017 tax cuts.

The Post reported the plan also would include mechanisms to combat tax evasion, such as more funding for the IRS, a measure to require all those paying the wealth tax be subject to an audit and a one-time penalty for those with over $50 million who have tried to renounce citizenship.

Warren’s campaign did not immediately respond to a request for comment from Fox News.

OCASIO-CORTEZ AGREES THAT A WORLD THAT ALLOWS FOR BILLIONAIRES IS IMMORAL

Rep. Alexandria Ocasio-Cortez, D-N.Y., said earlier this month that she wanted to fund her Green New Deal in part by slapping a tax as high as 70 percent on top earners. She said that, like in the 1960s, tax rates for those with incomes up to $75,000 could be as low as 10 or 15 percent, but much higher for those earning millions.

“But once you get to the tippie tops, on your ten millionth, sometimes you see tax rates as high as 60 percent or 70 percent. That doesn’t mean all $10 million are taxed at an extremely high rate. But it means that as you climb up this ladder, you should be contributing more,” she said.

Warren’s plan likely would hit a buzzsaw of opposition from Republicans, who champion the benefits of free-market economics and low tax rates. However, there could be some breakaway support for such a plan from some of those on the nationalist right in particular -- a segment of the right that has questioned free-market dogmas and where higher taxes on the rich are not always anathema.

Former White House chief strategist Steve Bannon reportedly pitched a plan that would increase the tax rate to 44 percent on those earning more than $5 million -- although the plan was not adopted. Meanwhile, conservative firebrand Ann Coulter has shown support in the past for taxes on the very rich, particularly as she says they would be aimed at liberals and those who support lax immigration policies.

CLICK HERE TO GET THE FOX NEWS APP

“Forget the top 2 percent,” she said in a 2012 column. “The top 1 percent of the top 1 percent keep voting for higher taxes -- and then take advantage of indefensible tax loopholes and deductions. Get them.”

Recently, she reacted to a call by the Chamber of Commerce for an extension of protections to illegal immigrants who came to the country as children, by tweeting: “I can’t wait for the 70-80% tax on the rich. MAKE SURE IT’S A WEALTH TAX, LIBERALS.”

Fox News’ Peter Doocy and Tara Prindiville contributed to this report.