Sen. Rubio responds to critics of child tax credit amendment

Florida congressman speaks out about tax reforms, potential DACA deal on 'The Ingraham Angle.'

Tax reform won Senate approval in a 51-49 vote shortly before 2 a.m. ET on Saturday, Dec. 2.

The White House and Senate GOP leaders announced before the vote that they believed they had enough votes to pass their sweeping tax overhaul plan.

In order to get enough support, GOP lawmakers considered different measures to include with the bill.

Republicans only had two votes to spare in the Senate, where they held a 52-to-48 edge. Vice President Mike Pence would've broken the tie, if needed.

Here’s a look at some key Republicans who needed to be persuaded to get on board with the plan.

Steve Daines

Sen. Steve Daines, R-Mont., said he is optimistic that changes could be made to the tax reform bill that would get him on board with the plan. (Reuters/Larry Downing)

Sen. Steve Daines, R-Mont., had some concerns about the tax reform legislation, but his spokesperson told Fox News Friday morning that he now supports the measure.

Daines previously said he was “optimistic” that the improvements could be made to the bill before it’s time to vote. And he said Wednesday he'd vote yes to move the motion.

Ron Johnson

Sen. Ron Johnson, R-Wis., has warned that he could vote against the GOP tax reform measure. (Reuters/Joshua Roberts)

Wisconsin’s Sen. Ron Johnson originally wasn't too big of a supporter of the tax bill, but after meeting with Senate leadership and Trump, he voted it through the Budget Committee.

He told Fox News that Trump promised to fix some of the problems he had with the measure and would work with them as the bill moves to the full Senate. Johnson's spokesperson said the senator would vote for the bill because of concessions made on pass through taxes.

Susan Collins

Sen. Susan Collins, R-Maine, said she was optimistic about tax reform after meeting with President Trump. (Reuters/Joel Page)

When it came to Republicans’ efforts to overhaul the health care system, Sen. Susan Collins, R-Maine, was not on board. Now Republicans are looking to see if she’ll join them on taxes.

Collins has reportedly said there are things she is “trying to change” regarding the current legislation. But after meeting with the president Tuesday, Collins said she was feeling "optimistic" about tax reform.

Bob Corker

Sen. Bob Corker, R-Tenn., is focused on how any tax reform legislation would impact the federal deficit. (Reuters/Joshua Roberts)

Sen. Bob Corker, R-Tenn., was the only Republican who joined Democrats in voting against the proposal.

Previously, Corker's stance on the bill was vague -- at least publically. He has said he’s concerned about how the legislation will impact the national debt, but he did vote it through the Senate Budget Committee Tuesday.

Corker wants to include a “backstop” or trigger in the legislation that would increase revenues even if the plan falls short.

After Trump's meeting with Senate Republicans, Corker said, "I think we're getting to a very good place on the deficit issue."

“While we are still working to finalize the details, I am encouraged by our discussions.”

Jeff Flake

Sen. Jeff Flake, R-Ariz., has stood at odds with President Trump, especially since he announced his retirement from Congress. (Reuters/Joshua Roberts)

Like Sen. Bob Corker, Jeff Flake has been publicly at odds with the Trump administration – especially since he announced his impending retirement from the Senate.

But Flake, R-Ariz., said Friday that he would vote for the Senate's tax reform plan.

Jerry Moran

Sen. Jerry Moran, R-Kan., did not commit to the tax reform measure at a town hall event. (Reuters/Larry Downing)

At a town hall event last week, Sen. Jerry Moran, R-Kan., refused to commit to the current tax legislation but did say that he is “for some tax bill.”

“Can we find taxes to cut that grow the economy? We don’t want to increase the debt and deficit as a result of tax cuts,” Moran said, according to the Topeka Capital-Journal. “My goal is to find out which taxes you cut can actually help create more jobs, better jobs, higher-paying jobs … and which ones don’t do that. Not all of them do that.”

Marco Rubio

Sen. Marco Rubio, R-Fla., has been an advocate for an increase in the child tax credit. (Reuters/Joshua Roberts)

Sen. Marco Rubio, R-Fla., told WFOR-TV that when it comes to tax reform, he’s looking for two components: a proposal that will make the U.S. “more competitive” and “take care of workers.”

SENATE REPUBLICANS CONSIDER TAX BILL FIGHT, EYE LIGHTER TRIM TO CORPORATE TAX RATE

Rubio has pushed for an expansion of the child tax credit and wants to make “it fully refundable against payroll taxes.” He introduced an amendment to the bill along with Sen. Mike Lee, R-Utah, that would raise the proposed corporate tax rate to offset costs by strengthening the child tax credit.

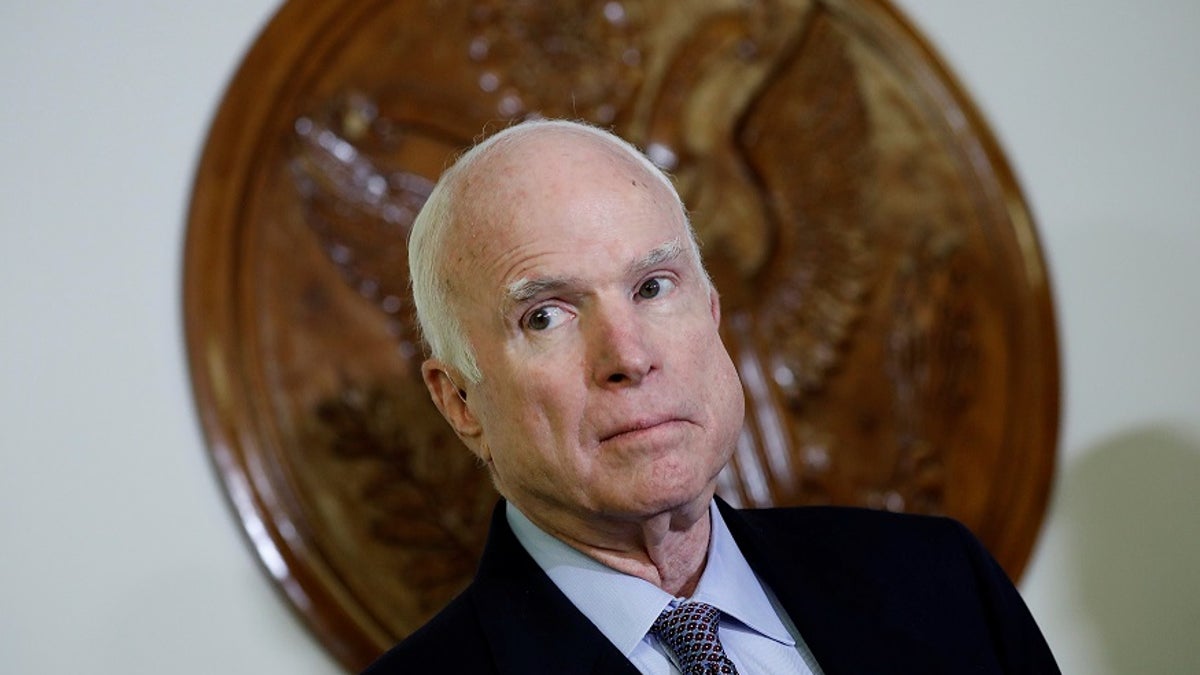

John McCain

Sen. John McCain, R-Ariz., praised the Senate Finance Committee for passing the tax measure through the use of regular order. (Reuters/Aaron P. Bernstein)

Sen. John McCain, R-Ariz., said Thursday that he would support the tax plan.

"I believe this legislation, though far from perfect, would enhance American competitiveness, boost the economy, and provide long overdue tax relief for middle class families," he said in a statement.

Like others, McCain is also considered a deficit hawk when it comes to the tax bill and was worried about its impact on the federal deficit.

“Finally, I take seriously the concerns some of my Senate colleagues have raised about the impact of this bill on the deficit. However, it’s clear this bill’s net effect on our economy would be positive. This is not a perfect bill, but it is one that would deliver much-needed reform to our tax code, grow the economy, and help Americans keep more of their hard-earned money.”

James Lankford

Sen. James Lankford, R-Okla., said he is for tax reform but wants to make sure it's done "right." (Reuters/Joshua Roberts)

Sen. James Lankford, R-Okla., wants to make sure the legislation doesn’t increase the federal deficit but finally said Tuesday he was "on board with" the plan.

"Yes, I am on board with this bill because I want to see the good economic growth that's coming with it," Lankford told CBS News.

He had previously been seen as someone whose support was uncertain.

Lisa Murkowski

Sen. Lisa Murkowski, R-Alaska, could potentially be convinced to vote on the tax reform measure if it includes certain provisions for her state. (Reuters/Yuri Gripas)

A more moderate Republican, Sen. Lisa Murkowski put speculation regarding her feelings on the tax measure to rest as she tweeted that she would support the bill due to certain provisions that she said will benefit her state of Alaska.

“We still have work to do on this legislation and I look forward to debate on the Senate floor and my colleagues’ ideas to further improve it,” Murkowski said.

“The bill before us has a number of features that are very attractive to Alaskans. It lowers tax rates, doubles the child tax credit, and provides tax relief for many families by doubling the standard deduction,” she said.

Murkowski also praised the tax bill as it comes with a provision that would allow drilling in Alaska’s Arctic National Wildlife Refuge – something that she’s long pushed for.

Fox News’ Peter Doocy and The Associated Press contributed to this report.