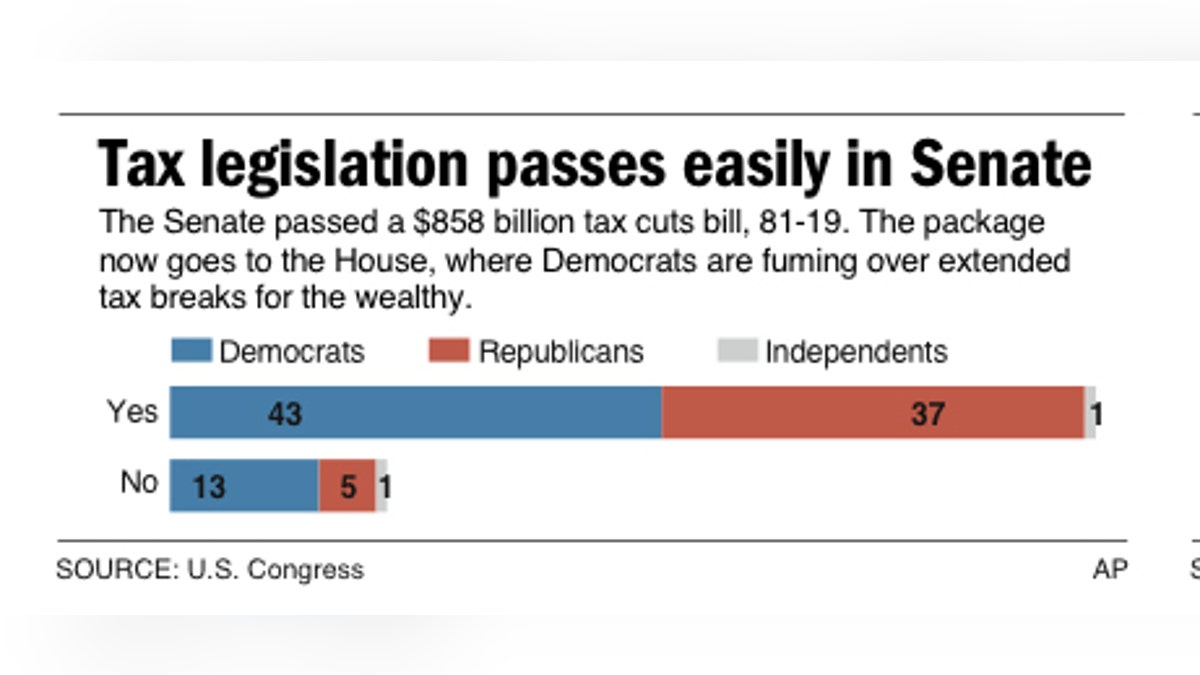

Graphic shows voting results on Senate tax cuts bill. (AP)

WASHINGTON -- The debate on a tax extenders bill worth $858 billion is going to the House after the Senate overwhelmingly approved the legislation, but House Democrats are grousing over deals to give breaks to wealthy estate owners and a costly payroll tax holiday.

The 81-19 vote in the Senate cleared the tax rate compromise legislation to move to the House, but that's where problems lie.

House Democratic leaders are debating among themselves on how to handle the estate tax, which as written would tax families at 35 percent on property worth over $5 million. Democrats it should be 45 percent on estates worth more than $3.5 million.

The other problem is the Social Security payroll tax holiday that reduces employee contributions from 6 percent to 4 percent. The cost for the one-year holiday is $120 billion. Currently, Social Security will be insolvent in 2037. This would drop the insolvency date to 2023.

That fact is starting to make the payroll holiday as nettlesome to House Democrats as the estate tax issue.

A group of Democratic representatives said that the payroll tax holiday endangers the fiscal soundness of Social Security and he has no confidence that the tax break will stop once it has been started.

"This will open the door to cutting Social Security benefits," said Rep. Ted Deutch, D-Fla.

Rep. Lloyd Doggett of Texas, who led the group, noted that public workers in some states do not pay the tax and would not get any benefit from the holiday. Rather than having a tax holiday, the members said they would rather have an extension of a tax credit passed in the 2009 stimulus that is being discontinued. They have not gotten assurance from Democratic leadership that a vote on their alternative will happen.

As for the estate tax, House Democrats could try to make it a stand-alone bill or maybe "split" the bill so those who are opposed to the estate tax language can have their say without blowing up the entire bill.

It could also be treated as an amendment. However, if the House changes or alters the bill, that ignites a firestorm among Senate Republicans who say the deal is locked in stone. And a change by the House means the bill must go back to the Senate, setting up the potential to stretch out the debate over time so that no one sees the endgame.

The House plans to tackle the bill Thursday. President Obama has repeatedly urged Congress to pass the legislation negotiated between the White House and Republicans.

"Today, the Senate passed with strong bipartisan support a bill that's a win for American families, American businesses, and our economic recovery. This vote brings us one step closer to ensuring that middle class families across the country won't have to worry about a massive tax hike at the end of the year," the president said in a statement.

"As this bill moves to the House of Representatives, I hope that members from both parties can come together in a spirit of common purpose to protect American families and our economy as a whole by passing this essential economic package," Obama said.

The tax deal package would extend current income tax rates for another two years and add hundreds of billions in additional spending through sweeteners and a 13-month extension in jobless benefits.

The legislation also keeps capital gains and dividend tax rates the same, provides Alternative Minimum Tax relief, which affects middle class families, extends the child and earned income tax credits, extends the tax credit to college more affordable, renews the $1.00 per gallon biodiesel tax credit and 45¢ per gallon ethanol blenders' credit, extends the credit for people taking on renewable energy projects at home.