Today’s Senatorial grilling of Goldman Sachs executives comes, not coincidentally, in the midst of the Democrats’ stalled push for their so-called regulatory reform bill. The SEC’s inspector general is already investigating whether the timing of the commission’s civil charges against Goldman were politically orchestrated.

Now the Senate is piling on, giving the Democrats a badly needed opportunity to portray themselves as the good guys willing to take on Wall Street, and ratchet up pressure for their so-called reform bill.

One minor problem: it isn’t true.

While Obama claims opponents of his so-called financial reform bill are on the side of the big banks, the big banks are on his side. In fact the Center for Responsive Politics reports Wall Street has given 63 percent of its political contributions this cycle to Democrats, up from 57 percent in 2008.

Scandal-plagued Goldman Sachs has given 69 percent of its political contributions this cycle to Democrats, only slightly down from 2008, when it gave 75 percent to Democrats -- including nearly a million dollars to Barack Obama and $112,400 to Senate Banking Committee Chairman Chris Dodd.

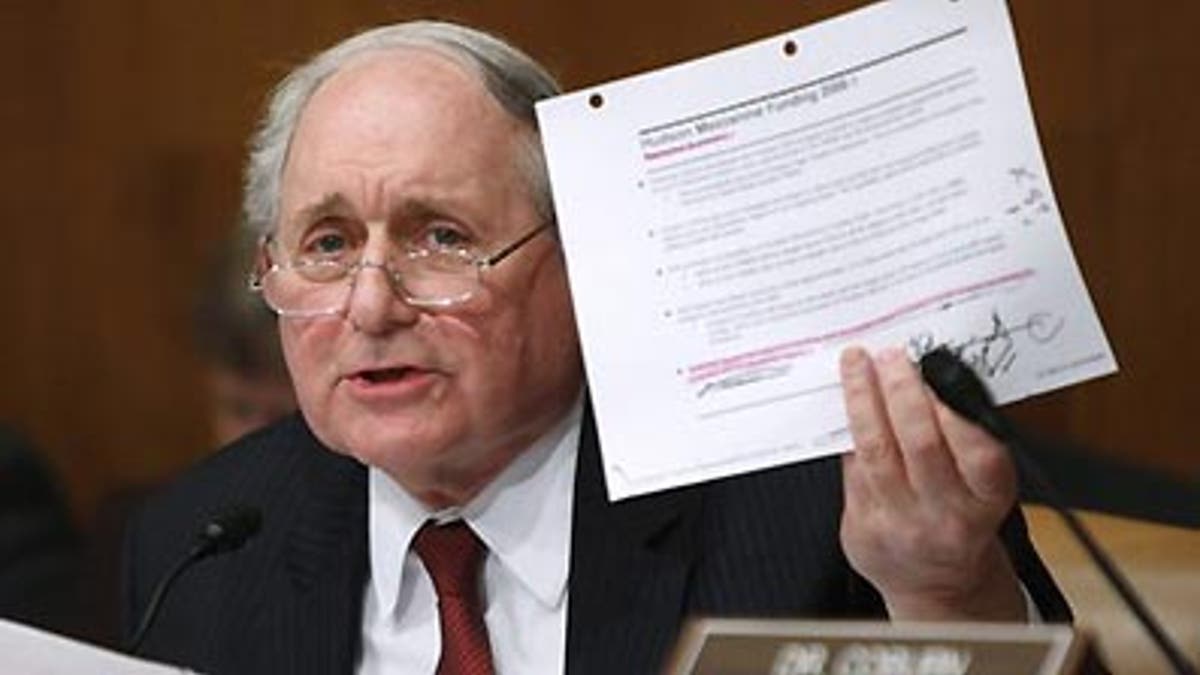

The idea of Dodd portraying himself as a reformer is particularly egregious. He is retiring instead of facing voters, largely because he is unable to explain away his own involvement in a housing-related scandal, namely a sweetheart-loan that Countrywide gave him under its “Friends of Angelo Mozilo program.”

Bank stocks went up after Obama’s big Wall Street speech last week. Probably because his bill institutionalizes too big fail. It doesn’t break the banks up and it assures them access to Federal Reserve loans as needed. It makes bailouts permanent. Goldman, with its close ties to the administration, will, after taking its lumps in this ongoing P.R. stunt, likely benefit if Democrats can get their bill through as a result.

But Main Street America will pay big time. Not only because as taxpayers we’ll be on the hook for future bailouts. Also because the vast new bureaucracy created by the bill, the so-called Consumer Financial Protection Agency, will have sweeping powers to disrupt and interfere with commerce down to even small businesses. And one of the worst figures in the housing crisis, Eric Stein, formerly of the left-wing group the Center for Responsible Lending (which had a large and under-investigated role in creating and collapsing the subprime bubble) may be empowered to lead the new agency.

Washington created "too big to fail" with regulations which led to the bailouts – yet this agency would give politicians and bureaucrats even more power. It's these same regulators who were asleep at the switch with Madoff, Fannie, Freddie, ACORN, the Center for Responsible Lending, and everyone else who created and then imploded the subprime bubble.

Congress already created the Financial Crisis Inquiry Commission for this purpose. The commission is far from perfect in its structure and its personnel, but shouldn’t Congress at least wait for its report before rushing to regulate?

We need a full investigation, going far beyond Goldman Sachs and covering the overall financial crisis—including the role of government and housing advocacy groups—before Congress rushes to implement so-called reforms that could end up empowering the very people who should be punished.

Mr. Kerpen is vice president for policy at Americans for Prosperity. He can be reached on Twitter, Facebook, and through www.PhilKerpen.com.

Fox Forum is also on Twitter. Follow us @fxnopinion.