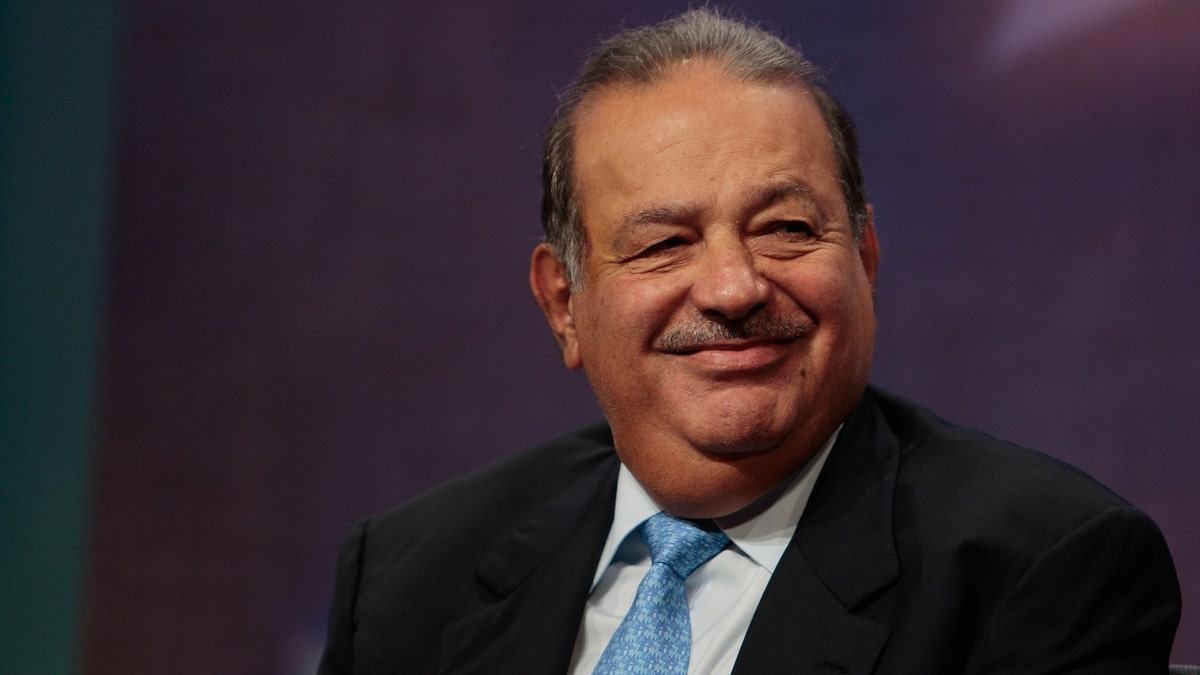

NEW YORK - SEPTEMBER 27: Mexican businessman Carlos Slim Helu, one of the world's richest men, smiles during a panel discussion about Latin America at the Clinton Global Initiative September 27, 2007 in New York. (Photo by Chris Hondros/Getty Images) (2007 Getty Images)

AMSTERDAM – The world's richest man appears poised to fully take over a Dutch telecom group.

As its largest shareholder, Mexican billionaire Carlos Slim gave his blessing for Dutch telecom group Royal KPN NV to sell its German unit E-Plus to Spain's Telefonica after it sweetened the offer to $11.4 billion.

A statement issued by KPN Monday said that Slim's America Movil would give its "irrevocable commitment" to back the E-Plus sale.

This would leave the path open for Slim — who according to Forbes magazine is the world's richest man with a $73 billion fortune — to proceed in his quest to acquire the rest of KPN, which has major operations in the Netherlands and Belgium.

In July KPN agreed to sell E-Plus in exchange for $6.7 billion in cash and a 18 percent stake in Telefonica Deutschland, worth an estimated total of $10.4 billion. Monday's deal increases the stake KPN will receive in Telefonica Deutschland to 21 percent.

The E-Plus-Telefonica Deutschland combination, if approved by European regulators, would create a strong competitor to Germany's largest mobile operators by revenues, Deutsche Telekom and Vodafone PLC.

KPN shareholders are due to vote on that deal Oct. 2.

Analysts for ABN Amro said in a note Monday that it was "remarkable that America Movil has endorsed the E-Plus sale, because the German unit was an important pillar of its European expansion plans."

In a separate statement Monday, America Movil said it was still committed to buying KPN and clarified its plans for the Dutch company, saying it wants to strengthen the company with superior technology, better procurement and more investment.

"America Movil intends to respect the identity of KPN," the statement said. It promised to keep the KPN brand and the company's headquarters in The Hague, Netherlands.

Slim has built a stake of just under 30 percent of KPN via America Movil over the past two years. Following KPN's initial plan to sell E-Plus, Slim launched a bid to acquire the 70 percent of KPN he doesn't already own for 2.40 euros per share, or 7.2 billion euros. At the time, Slim didn't disclose whether he would support or oppose the E-Plus sale, and many interpreted the move as a hostile takeover bid and a way to block the Telefonica deal.

Movil said it would "investigate expansion investments that will differentiate KPN as a leading telecom service provider in its home markets." It added that if fewer than 95 percent of KPN shareholders tender shares to its offer, it will maintain KPN's Dutch stock market listing and guarantee minority shareholders' rights.

KPN's boards have yet to issue an opinion on Movil's offer but analysts said Monday's statement from the Mexican company addressed several concerns raised by the KPN Foundation — a company institution common in the Netherlands which has the power to issue extra shares to thwart unwanted takeovers.

Shares in KPN were trading at 2.33 euros Monday, slightly under Movil's offer price.

Based on reporting by The Associated Press.

Follow us on twitter.com/foxnewslatino

Like us at facebook.com/foxnewslatino