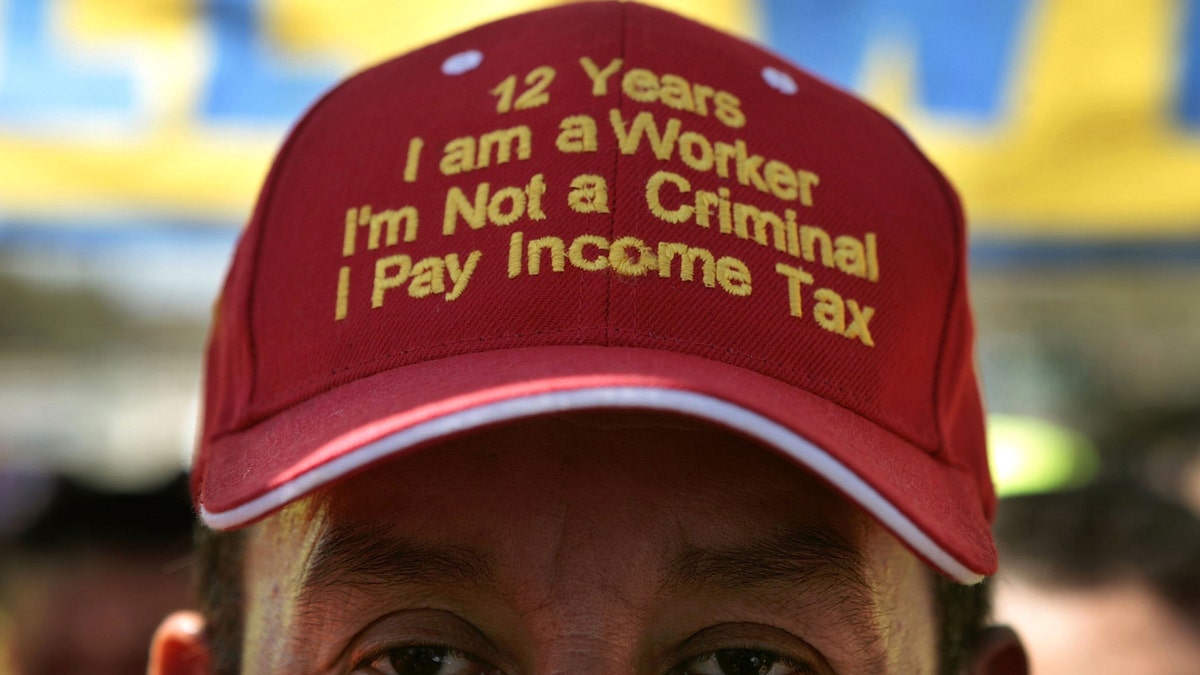

Colombian immigrant Edgar Duque of Union City, New Jersey, wears a hat that reads, "12 Years, I am a Worker, I'm Not a Criminal, I Pay Income Tax" (Photo by Chip Somodevilla/Getty Images) (2006 Getty Images)

The federal government wants everybody earning money in the country to file their taxes — whether they're in the country legally or not.

For undocumented immigrants who don't have legitimate Social Security numbers with which to file, the best alternative has been to use an option called "Individual Tax Identification Number," or ITIN, issued by the Internal Revenue Service.

But recent anti-fraud changes in law have made it harder for them to obtain ITINs. The issue could have potential national repercussions since current talks on a possible amnesty program include undocumented immigrants showing they've paid taxes.

Applicants are now required to submit original documents, such as a passport, national identification card, or driver’s license along with their return.

By requiring immigrants to submit original identification documents or certified copies, the IRS hopes to deter fraud and improve the tax refund process. And while the application and renewal process for ITINs remains unchanged, the new numbers issued now will only be good for a five-year period rather than indefinitely.

According to some experts, this move by the IRS has created a general level of nervousness among the immigrant community about what these documents will be used for and who will be seeing them.

In general, fearing deportation, undocumented immigrants tend to steer away from interacting with the federal government.

“The changes in the application process, I think, will drive the application numbers down,” Michael Petrucelli, former acting director of U.S. Citizenship and Immigration Services, told Fox News Latino. “They are trying to make sure ITINS are used only for the specific purpose they’re authorized.”

Tax and finance expert Mike Periu said the changes are a “point of contention.”

“It’s likely that it will drive down the application numbers,” said Periu. “The minute you tell them 'original documents,' that's when the hesitation sets in.”

One of the many misconceptions surrounding undocumented immigrants is that they do not file taxes. But according to the IRS, in 2011, over 1.7 million immigrants filed taxes using ITINs.

Issued regardless of immigration status, ITINs allow immigrants to record the economic contributions they are making in the country.

But even as some immigrants are leery of the changes, tax experts say undocumented immigrants should be more inclined to file their taxes this year. As the push to pass immigration reform steps into high gear, those immigrants who have filed taxes using ITINS will likely be in a better position when they apply for citizenship in the future.

The proposed immigration reform bill by the “Gang of Eight” includes stipulations that in order for any immigrant to earn a “probationary legal status,” which will allow them to live and work legally in the United States, they will have to pay any back taxes they may owe to the U.S.

“There is some prospective future benefit [for immigrants] if you’ve been paying taxes now,” Petrucelli said. “Someone who isn’t paying now and immigration reform becomes a reality, they could have to file returns to cover years before.”

He said once immigration reform passes, a lot of people will be asking more about ITINs.

“There’s an interesting correlation between immigration practice and immigration reform,” said Petrucelli.

While the federal tax law does not allow for the IRS to share any information with another organization like the Department of Homeland security, those opposed to the ITINs program argue that this information should be shared.

Ira Mehlman, spokesman for the Federation for American Immigration reform, an immigration- restriction group, said that while he feels this information should be made known to other government agencies, immigrants who do pay their taxes should not be looked on with more favor.

“Having an ITIN or filing taxes should not entitle” immigrants to the privilege of having U.S. citizenship, said Mehlman.

But those in favor of ITIN said it pours millions into the economy, and prevents immigrants from running afoul of tax laws. In 2010, the Institute for Taxation and Economic Policy estimated the undocumented immigrants paid over $1.2 billion in state and local taxes.

According to the report, the number represents the 50 percent of unauthorized immigrant in the country who pay taxes.

“I think it’s sort of a prevailing myth that undocumented immigrants don’t pay taxes,” Wendy Feliz, the communications director at the American immigration council, told Fox News Latino. “Having everyone pay taxes is a positive thing.”