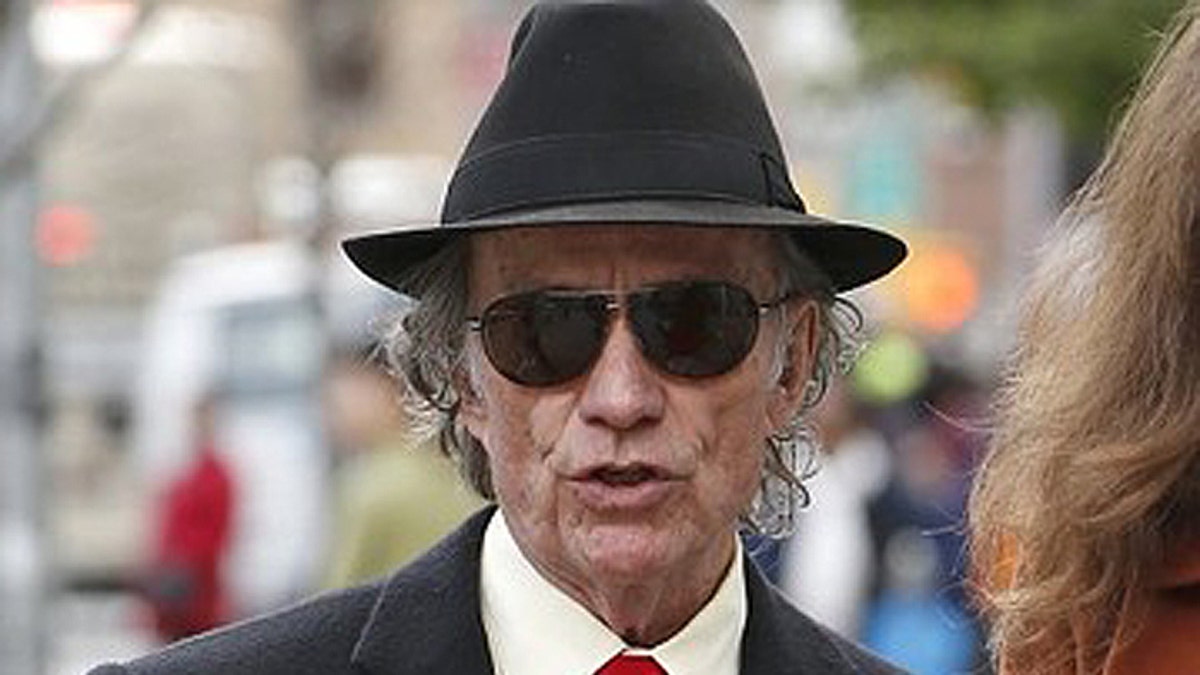

Sam Wyly says the bill the IRS hit him and his late brother's estate with is way out of whack. (AP)

Think you have problems with the IRS? A Texas man who with his late brother made billions from software, restaurants and the Michaels arts and crafts chain store has a tax bill of $3.2 billion.

The massive bill owed by Sam Wyly and the estate of Charles, three-quarters of which is interest and penalties, is believed to be the biggest in history. The IRS, presented it in court documents filed late Wednesday in U.S. Bankruptcy Court in Dallas, claiming Sam Wyly owes $2.03 billion in back taxes, penalties and interest from income generated from offshore trusts the brothers established more than two decades ago. The estate of Charles Wyly, who died in and Aspen, Colo., car crash in 2011, owes $1.2 billion, according to the agency.

But Wyly says he's paid his share, and plans to fight the bill in court.

“The IRS figures are baloney,” Sam Wyly, 80, told the Dallas Morning News.“I paid $160 million in taxes in the last 22 years, and my brother, Charles, paid $80 million. We firmly believe we have paid all the taxes we owe.

“We believe the IRS figures are so absurd as to undermine the credibility of the IRS,” he said.

The source of contention is trusts set up on the Isle of Man in the early 1990s to send a stream of $16 million per year to the brothers. The trusts, built with money from the brothers' various business interests, including Bonanza steakhouses, Michaels stores and a compuer services chain they started in the 1960s, are worth nearly $400 million, according to reports. Federal investigators, including ones from the Securities and Exchange Commission, say the brothers used the trusts to hide stock trades and avoid taxes.

Sam Wyly filed for Chapter 11 bankruptcy protection last fall and sought to settle claims by the SEC and IRS, Josiah Daniel, a Vinson & Elkins partner who represents Wyly, told the newspaper.

“This submission by the IRS is shocking,” Daniel said. “No one expected anything close to this amount. It may be unprecedented.”

Dee Wyly, Charles’ widow, filed for bankruptcy in Dallas last October.

“Dee Wyly has no idea how they arrived at these figures, nor does she have the means to pay such a gargantuan sum,” Stewart Thomas, a lawyer and longtime representative of the Wyly family, told the newspaper Thursday. “She and her late husband hired countless attorneys and accountants to advise them and help them fully comply with the IRS’ very complicated tax code. They have paid huge amounts of taxes every year, always intending to pay every penny they owe.”

U.S. Bankruptcy Judge Barbara Houser will hear arguments next January over the merits of the IRS’ claim, and then determine how much the parties owe.

Wyly founded University Computing in 1963 with $1,000 and developed it into a multimillion-dollar computer services company. In 1967, the brothers bought the restaurant chain, expanding it to 600 locations before selling at a huge profit in 1989. In 1982, the brothers bought the controlling interest in Michaels, growing the chain from a privately held company with $10 million in annual sales to a $1.2 billion public company 24 years later.