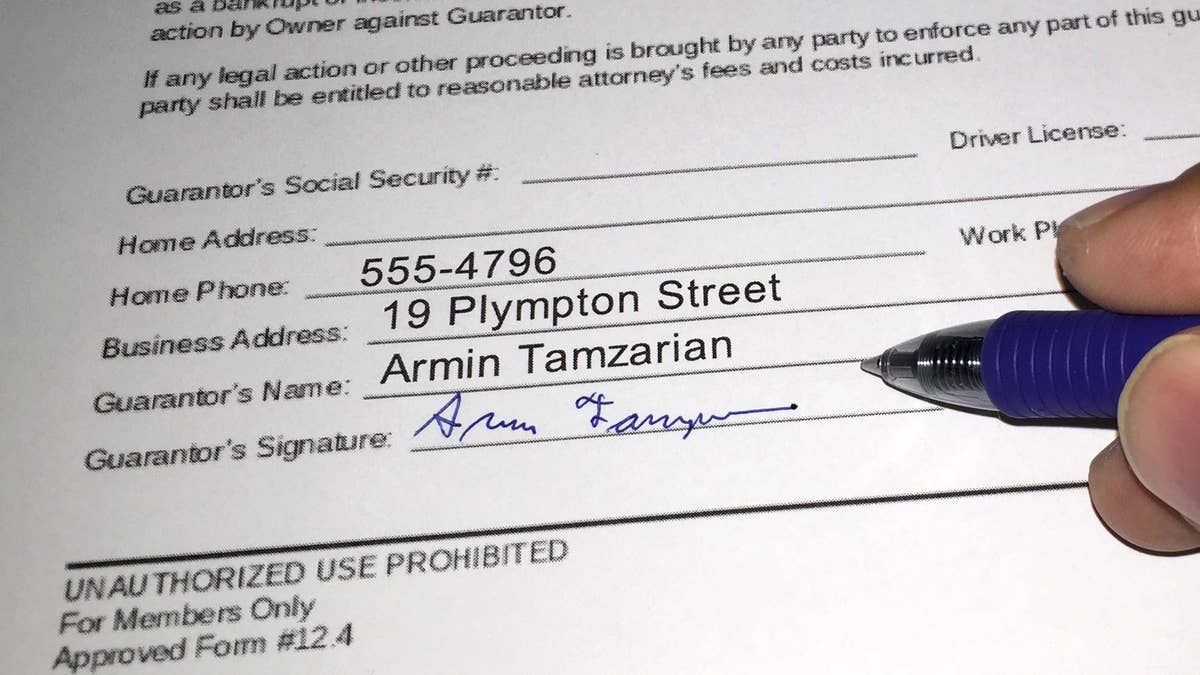

Guarantor form

Having an apartment of your own doesn't come cheap -- so if you're on the lower end of the income scale, finding an apartment may be a struggle, because landlords may fear that you won't be able to pay the rent.

If you find yourself in this situation, you may consider getting a guarantor, who's a lot like a fairy godmother who can help you get your foot in the door of your very own rental.

What is a guarantor?

A guarantor is a person who is willing to pay the rent if a tenant can't. Typically, this person is an immediate family member, but people can use anyone, like a friend or a colleague, who is qualified and willing.

Guarantor arrangements are common for tenants whose rental credentials are less than ideal -- i.e., they're often fresh out of college, in a low-earning job (if they have a job at all), and have little or poor credit history.

Guarantor arrangements are also common in high-priced markets such as New York, where a renter's annual income needs to exceed 40 times the monthly rent. So, for an $1,800-per-month apartment, you'd need a documented income of at least $72,000. That's pretty steep for someone who's just starting out!

Guarantors also help out in plenty of other scenarios, too.

"Guarantors are widely used, but they aren't just for students or people with less-than-ideal credit," says Ben Falchi, a senior associate at Cooper & Cooper Real Estate. "Guarantors help foreign nationals rent apartments, and they can even take the form of a corporation, guaranteeing an apartment for an employee."

In other words: There's no shame in needing a guarantor; it's a necessity in certain markets or during certain stages in life. That said, becoming a guarantor is a significant responsibility that could saddle someone with sizable extra expenses, so this relationship is not one to enter into lightly.

What a guarantor should expect

Landlords don't just accept guarantors at face value, but will put them through as thorough a screening process as they do tenants, checking credit score, bank statements, pay stubs, any outstanding debts, and more. After all, guarantors need to prove that in the event that their tenant can't pay the rent, they can step up to the plate and comfortably cover it along with their own monthly expenses. In most cases, they must be able to show, in earnings, an average of 80 times the tenant's monthly rent in annual income.

If a guarantor is approved, he or she will want to read the landlord's lease carefully -- particularly regarding what happens when rent is due, and any penalties for late payments -- as well as the letter or contract of guarantee delineating the agreement between guarantor and tenant. This duo should also be sure to ask about any legal requirements; for instance, some landlords ask that a guarantor live in their state or be present at lease signings.

Rules for a responsible guarantor/tenant relationship

Becoming a guarantor is a huge risk, both financially and emotionally should the tenant flake on paying rent -- even if the guarantor is good ol' Mom and Dad. As such, guarantors and tenants should lay down some rules such as the following:

- Agree on what the tenant should do in the event that he can't pay rent. How much notice should he give the guarantor?

- Determine whether the tenant will be responsible for paying back the rent later on.

- If the tenant begins earning more money or sees an increase in his credit score, he may want to remove the guarantor. If that's the case, ask your landlord what options are available and if you can renew the lease without the guarantor.

- Even in the worst-case scenario where a tenant can't pay rent, a guarantor will be off the hook once the lease up (typically in a year's time).

Bottom line: A guarantor isn't a free ride, just a helping hand to be used temporarily in a responsible and respectful way -- or else, this fairy godmother may be not be so helpful the next time around.

-- -- -- -- --

Watch: Is It Smarter to Rent or Buy?