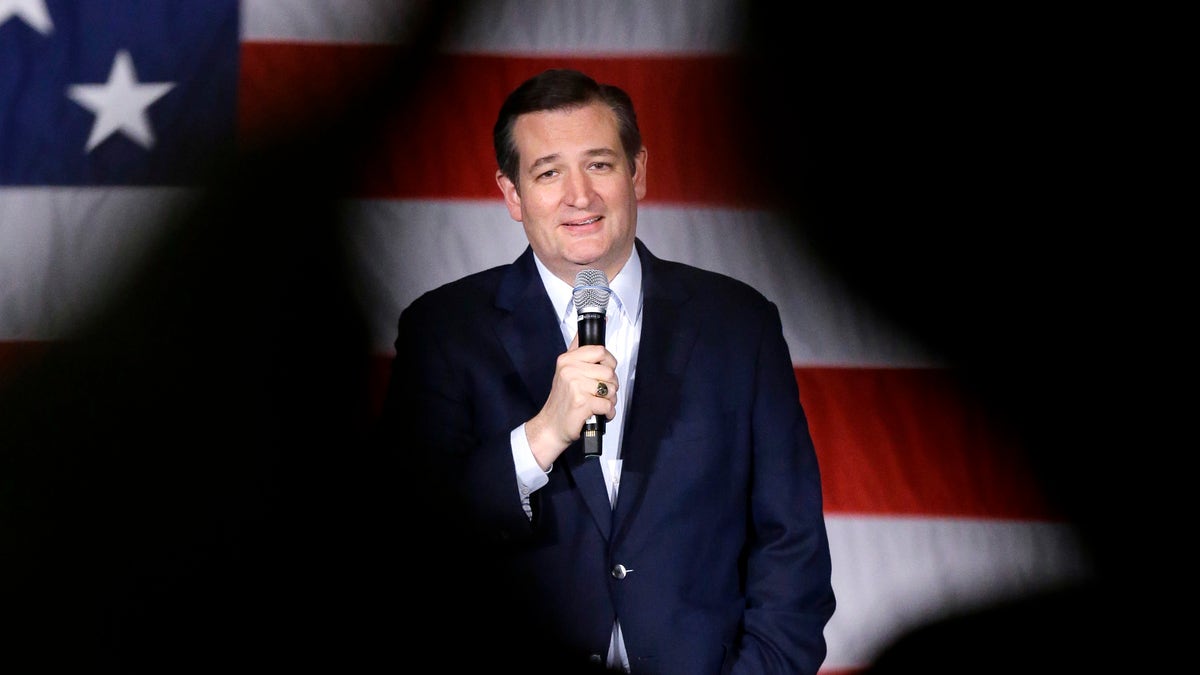

In this April 4, 2016, photo, Republican presidential candidate, Sen. Ted Cruz, R-Texas, speaks at a campaign stop at Waukesha County Exposition Center in Waukesha, Wis. Cruz is increasingly winning over voters to his presidential bid. Heâs still not winning over fellow Republican senators. The Texas Republican is notorious for alienating his colleagues with tactics including pushing a fruitless government shutdown in 2013 and accusing the Senate majority leader of lying. Theyâre now paying it back by refusing to get on board with his presidential bid even as he emerges as the likeliest alternative to businessman Donald Trump following a commanding win Tuesday night in Wisconsin.(AP Photo/Nam Y. Huh)

AUSTIN, Texas (AP) – When Ted Cruz kicked off his White House bid at Liberty University, he told the crowd "y'all can probably relate" to the $100,000-plus in student loan debt he ran up in college and paid off only a few years ago. Since then he's appealed for support from college seniors who are piled with student loans and scared about the prospects for getting out of debt.

But Cruz hasn't offered a plan to cut the cost of college and, in the Senate, opposed letting millions of Americans reduce their student loan payments. While working previously as a private lawyer in Houston, Cruz helped represent a lender who went to the Supreme Court to keep an Arizona man from avoiding interest payments on his student loans by filing for bankruptcy.

Cruz's half-sister, Roxana, borrowed about $35,000 before graduating from medical school at Boston University in 1991, then defied years of court orders in two states before finally settling the case by paying more than $64,000.

None of this helps the Texas senator's appeal with young voters. Many turned out for the Iowa caucuses won by Cruz, but Republicans under 30 generally haven't voted in significant numbers in many states since then. On average Cruz has been supported by 27 percent of those under 30 across all states with exit polling, compared with 30 percent for Republican rival Donald Trump.

Student loans can be a thorny issue for candidates. Trump has offered few ideas for easing student debt except to say the federal government shouldn't profit from such loans. Democrat Hillary Clinton came out last summer with a $350 billion plan to make college more affordable, only to be widely mocked after she asked on Twitter: "How does your student loan debt make you feel? Tell us in 3 emojis or less." The other Democrat in the race, Bernie Sanders, has gone the furthest on the issue with an expensive plan for free college education.

Alessandra Gennarelli, a University of Texas sophomore who is co-chairwoman of Millennials for Cruz, says the candidate's own struggle with college debt helps people relate to him and she's not bothered that he doesn't have a plan to lower college costs. "The main thing is fixing the economy," she said.

Cruz wrote in his autobiography that he relied heavily on student loans in college at Princeton while working two jobs, making $7.50 per hour at the campus video service and twice that at the tutoring company Princeton Review. Things got easier after he graduated from Harvard Law School. Before joining the Senate in 2013, Cruz was a private attorney in Houston where he made $1.7 million in salary and bonuses during his final year.

There, Cruz opposed Francisco Espinosa, an airline baggage handler who incurred more than $13,000 in debts to attend technical school in Arizona but then filed for bankruptcy — proposing to pay back the principal of his loan over time but not roughly $4,000 in interest.

Cruz helped represent Espinosa's lender and objected to bankruptcy protection because the original judge had not included a finding that paying back the loans with interest was an "undue hardship."

A brief co-signed by Cruz argued that excusing interest payments could "open the floodgates" and let others duck debts including "taxes, domestic support obligations, drunk driving personal injury and death liabilities and criminal fines and restitution."

The case reached the Supreme Court, which ruled 9-0 against Cruz's side. Charles Wirken, an Arizona attorney who also represented the lender, said, "We didn't really care about (Espinosa's) $20,000. It was the millions and millions and millions of dollars at stake in other bankruptcies."

"If people could go to school, borrow money — tens of, or hundreds of thousands of dollars — and then just turn around and ... dash into a bankruptcy and get it discharged, that would have substantial consequences," Wirken said. He contended, despite the high court's unanimous decision, that Cruz was "on the side of the law and rules."

Cruz's half-sister spent years on the wrong side of her student loan. Court records showed that Boston University sued Roxana L. Cruz in June 1999 for failing to pay $34,735 in student loans and attorney's fees. That November, the Boston Municipal Court ordered Cruz to pay nearly $38,000, but she didn't comply until Boston University sued her again in 2007, this time in New York, where she was then living. She settled the case the following January for nearly $64,300 including more than $26,000 in interest that had accrued on the original borrowed amount.

Roxana is the daughter of Ted Cruz's father, Rafael, before he married Ted's mother. Now a physician in the Dallas suburb of Greenville, Texas, she has declined to speak to reporters. Cruz's campaign also declined to answer questions about the case.

In the Senate, Cruz opposed efforts in 2014 and last year to let millions of borrowers refinance student loans at lower interest rates. He and other Senate Republicans teamed up to defeat Massachusetts Democratic Sen. Elizabeth Warren's proposals because they would have been paid for by increasing taxes on rich Americans — setting increased minimum rates for people making over $1 million.