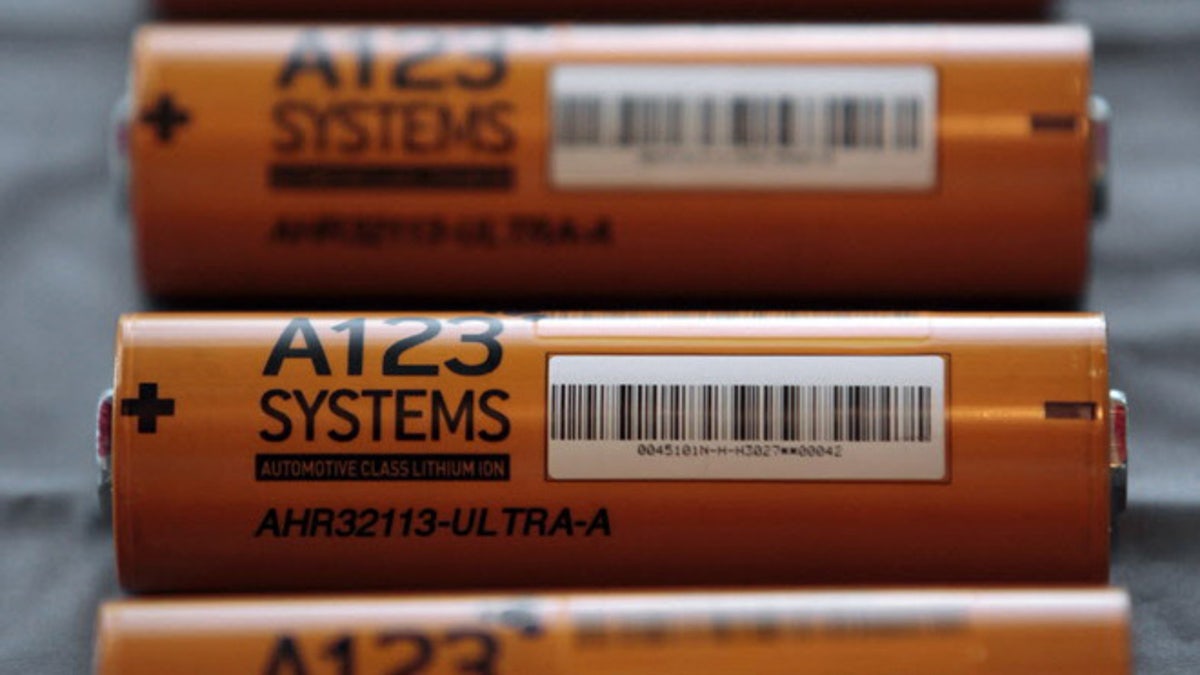

The U.S. government has approved the sale of U.S. taxpayer-backed A123 Systems to a Chinese company, despite security and economic concerns about sensitive technology changing hands.

A representative with A123 Systems confirmed Tuesday to FoxNews.com that Wanxiang America Corp. has gotten approval from a Treasury Department agency to take over "substantially all" of the non-government business assets of the lithium ion battery manufacturer.

"We're pleased the government has completed its review and provided us with the go-ahead to finalize this transaction," Pin Ni, president of Wanxiang America, said in a written statement.

A representative with the Committee on Foreign Investment in the United States -- an inter-agency panel chaired by the Treasury Department that would have made the decision -- declined to comment.

The move comes despite concerns from lawmakers on both sides of the aisle about a Chinese firm taking over a company -- and technology -- that U.S. taxpayers helped fund through $249 million in grants. Of that money, about $130 million had been released so far, the Department of Energy said.

The grant “was used for the construction of brick and mortar advanced battery manufacturing facilities at two Michigan locations," Energy Department spokesman Bill Gibbons said. "The purchase of these assets includes the Energy Department’s requirement that the plants and equipment partially paid for by the Recovery Act stay in Michigan and continue to operate, generating job opportunities for American workers and helping to establish a domestic manufacturing base for this growing global market.”

Even so, the deal would essentially transfer sensitive battery technology with "key military applications," according to one group that opposed the sale.

The company, which failed to turn a profit, filed for bankruptcy in October. It was bought at auction by Chinese-owned Wanxiang, an auto parts company, after the company beat out a combined offer from Milwaukee-based Johnson Controls and NEC Corp. of Japan.

The concern among U.S. lawmakers was that if the sale goes through, the Chinese would have access to years of high-tech advancements.

At the helm of Wanxiang Group is auto parts magnate Lu Guanqiu. One year ago he was the third richest man in the National People's Congress, and today he continues to have close ties with the Communist Party. That worries some lawmakers.

"Congress is seeing an increasing threat coming out of Beijing where they are methodically purchasing U.S. corporations," Rep. Marsha Blackburn, R-Tenn., told FoxNews.com last week. "The problem with the A123 sale is not only have taxpayers had a $230 million stake in the company's success but Beijing will now have access to sensitive materials that are currently being used in U.S. defense and utility grid contracts."

Blackburn said the sale wasn't a partisan issue but a "clear-cut one of national security."

The sale, if approved by the bankruptcy court, comes amid warnings -- even by the CFIUS -- about efforts by foreign governments to take over U.S. firms.

In a December 2012 report, the CFIUS said that the U.S. intelligence community "judges with moderate confidence that there is likely a coordinated strategy among one or more foreign governments or companies to acquire U.S. companies involved in research, development, or production of critical technologies for which the United States is a leading producer."

Originally developed by NASA's Jet Propulsion Laboratories, the technology behind the ultra-light lithium-ion phosphate batteries being bought will play a major role in modernizing the way electricity is generated and distributed. The new tech could also be used in key military operations and to power satellites and unmanned military drones.

But as the pressure to stop the sale mounted over worries that giving up decades of scientific study could cripple the country's ability to compete with China in the future, Wanxiang came up with a plan of its own.

The Chinese company created a new independent trust to buy A123's civilian unit. The civilian arm makes up the bulk of the company's operations. The idea would then be for Wanxiang to buy the business from the trust.

Another company reportedly will buy A123's government business arm which works with the U.S. military.

The company has said that splitting the sale between the military and government operations should quell security fears.

"We have worked closely with the Committee for Foreign Investment in the United States to address any potential national security concerns, and have taken action to exclude A123's government and military business from our transaction with Wanxiang America Corporation," A123 Systems said in a statement to FoxNews.com last week.

In his statement Tuesday, Pin Ni said "Wanxiang America is committed to its long-term success and the continuance of its U.S. operations. Wanxiang America looks forward to closing the transaction and to continuing to foster the technologies A123 has worked so hard to develop."