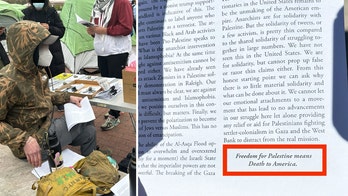

(National Republican Congressional Committee/AP)

All the White House had to do Wednesday was rule it out.

For days, the press and the pundits were abuzz with the fanciful notion that maybe -- just maybe -- the Treasury Department could avert a standoff over the debt ceiling by minting a cure-all trillion-dollar coin.

Surely, the White House would dash the idea, no?

But when asked, repeatedly, about the possibility, White House Press Secretary Jay Carney hedged.

Then he hedged again. And again.

- Funny Money: Pundits float $1 trillion coin as answer to debt-ceiling standoff

- Governors warn Congress over debt limit

- Budget watchdogs extend campaign, say recent fiscal deal doesn’t cut it

- Democrats, Republicans battle along familiar lines ahead of new fiscal talks

- Sen. Sessions: Withhold debt-ceiling increase until Senate passes budget plan

- House Dems urge Obama to raise debt ceiling unilaterally if Republicans resist

And the legend of the trillion-dollar coin continued to grow.

Lawmakers are now railing against the idea, which has -- left unchecked -- become a seemingly legitimate point of debate. The National Republican Congressional Committee has launched a petition urging people to oppose the use of trillion-dollar coins to address any debt crisis.

NRCC Chairman, Rep. Greg Walden, R-Ore., says he plans to introduce a bill to short-circuit any such plan.

"This scheme to mint trillion-dollar platinum coins is absurd and dangerous, and would be laughable if the proponents weren't so serious about it as a solution. I'm introducing a bill to stop it in its tracks," he said in a statement.

In theory, here's how the trillion-dollar coin thing would work. Proponents of the idea point to a tiny section in the U.S. code that allows the Treasury secretary to "mint and issue platinum bullion coins and proof platinum coins" of a size and denomination of "the secretary's discretion." This is mainly for commemorative coins, but the idea is that the provision could be exploited as an ace-up-the-sleeve for the administration if Republicans try to block an increase in the debt ceiling. The argument is that minting a trillion-dollar coin is as ridiculous as Congress refusing to pay debts it has already accumulated ... so why not?

The White House, asked Wednesday about the idea, repeatedly said "there are no backup plans, there are no Plan Bs" other than for Congress to approve a debt-ceiling increase.

But while the White House has explicitly ruled out another option -- using an obscure provision of the 14th Amendment to unilaterally raise the debt ceiling -- Carney on Wednesday did not explicitly rule out the coin.

"Look, there is no substitute for Congress extending the borrowing authority of the United States," Carney said.

He was then asked: "Will you totally rule it out?"

Carney answered: "You could speculate about a lot of things, but there is -- nothing needs to come to these kinds of speculative notions about how to deal with a problem that is easily resolved by Congress doing its job, very simply."

Asked again later during the briefing about the coin, Carney said reporters should ask the Treasury Department "since Treasury, I believe, oversees printing and minting." Then he joked, "I have no coins in my pocket."

The Treasury Department, though, later declined to comment.

Nevertheless, the coin option appears to be highly unlikely.

"It's just a disguised new form of debt," former Congressional Budget Office director Douglas Holtz-Eakin told FoxNews.com earlier this week. "This would say (to the markets) they cannot manage their finances as a nation, they're down to gimmicky coins."

He added: "It would have all the implications of near-default."

Mark Calabria, director of financial regulation studies at the Cato Institute, said it's legally doable but "extremely unlikely."