(AP)

Senate leaders from both sides of the aisle vowed late Friday to scramble over the weekend to produce a new bill aimed at averting the fiscal crisis, on the heels of a high-stakes White House meeting -- seen as the last chance to come together before the tax-hike deadline next week.

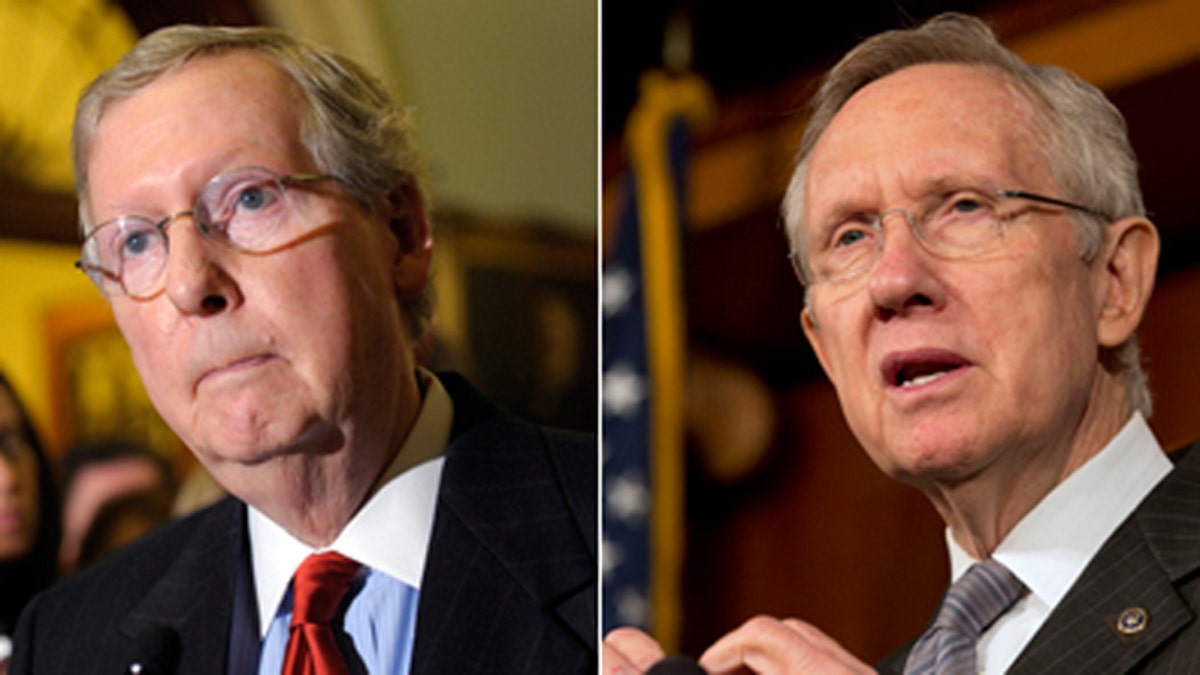

Though the meeting did not yield a breakthrough or any "concrete" proposals, Senate Democratic Leader Harry Reid and Republican Leader Mitch McConnell gave taxpayers a glimmer of hope by announcing on the floor that the Senate would adjourn Saturday to allow staff to work on a bill. McConnell said he hopes they can come forward with a recommendation as early as Sunday.

"We need to have everybody step back a bit," said Reid, who called the meeting "very constructive."

The pledge to work on a new bill is by no means a solution to the sweeping set of tax hikes set to hit Jan. 1, followed by steep spending cuts. Lawmakers still have to write the bill, and produce something that can pass both chambers.

President Obama, speaking from the White House briefing room late Friday, voiced a dose of doubt about the Senate leaders' final push for a deal.

- As fiscal crisis looms, taxing charitable gifts by the rich will hurt the poor the most

- Lawmakers ramp up the rhetoric, with no plan in sight to avert fiscal crisis

- What will it cost you? Fiscal deal failure would dent monthly budgets for millions

- Pentagon, defense industry brace for looming spending cuts

He said he's "modestly optimistic" but that if Reid and McConnell fail, the Senate should allow an up-or-down vote on a scaled-back proposal the president is pushing.

"The hour for immediate action is here, it is now," Obama said. "We're now at the last minute, and the American people are not going to have any patience for a politically self-inflicted wound to our economy. ... We've got to get this done."

Considering how late this effort is getting underway, lawmakers easily run the risk of missing the deadline and causing at least some uncertainty with Americans' tax bills starting next week.

The developments late Friday, though, at least showed Reid and McConnell were beginning to work together. And it marked a decision by lawmakers that the Senate should make the first move -- for days, House Speaker John Boehner has insisted that the Senate act, but Reid has resisted and put the onus on the House.

It's unclear what the new bill would entail. It appears the Senate wants to tweak the Obama plan, which would include an extension of current tax rates for most Americans -- but potentially adjust it so fewer earners see a tax hike, and add a provision dealing with a looming expansion of the estate tax.

The debt ceiling, which Obama wants increased, would not be part of this bill. And a senior White House official admitted it is unclear how a looming set of spending cuts would be addressed.

The White House official said that during the meeting, Reid and McConnell jumped in and offered to draft a new plan after Obama told them he thought his scaled-back proposal could pass both chambers.

The president's plan is a far cry from the kind of "grand bargain" lawmakers were shooting for just a few weeks ago -- something that would narrow the deficit, overhaul the tax code and set the country on a course to curb its entitlement spending, all while averting massive tax hikes and spending cuts.

Instead, Obama wants a bill that primarily nixes the tax hikes for families making under $250,000. He has pushed that particular provision for months, though Republicans have adamantly opposed raising taxes on those making above $250,000.

Obama's proposal would also extend unemployment benefits for roughly 2 million people expected to lose them next year, and deal with "other outstanding issues."

Obama referred to those other issues last week when he called for laying "the groundwork for future growth and deficit reduction," which presumably would be a commitment to return next year and draft broader tax and entitlement reform.

The latter idea, though, could stir deep skepticism in Congress -- the last big budget deal in the summer of 2011 ended precisely with such a commitment, which in turn ended in failure and the fiscal crisis facing the country today.

The immediate challenge for negotiators, though, will be to craft a plan that does enough to spare most Americans a big hike without doing so much as to complicate the bill's passage. There are a host of expiring provisions next year -- from Medicare rates to doctors to payroll tax cuts -- that some lawmakers hoped to address before the end of the month. The more items added to the bill, the trickier it gets to pass it.

Lawmakers have been hesitant to predict whether Congress will be able to arrive at any solution.

"We are obviously running out of time here," McConnell said earlier Friday.

Lawmakers effectively have fewer than two working days to pass legislation. While the Senate was in session this week, the House does not return until Sunday afternoon.

Between now and Jan. 1, Congress has just a handful of options for sparing taxpayers. Aside from the scaled-back plan being offered by Obama or the new plan being drafted in the Senate, lawmakers could simply pass a short-term extension of current rates -- buying more time to work out an agreement. Lawmakers might have to do this even if they reach an agreement by the weekend -- because of the sheer time it would take to write that bill and bring it to the floor.

Or Congress could let the tax hikes happen, only to retroactively deal with them next year. The Boston Globe reported Friday that the IRS may delay the impact of tax hikes by holding off on telling employers to change how much they withhold from workers.

Fox News' Ed Henry and Chad Pergram and Fox Business Network's Rich Edson contributed to this report.