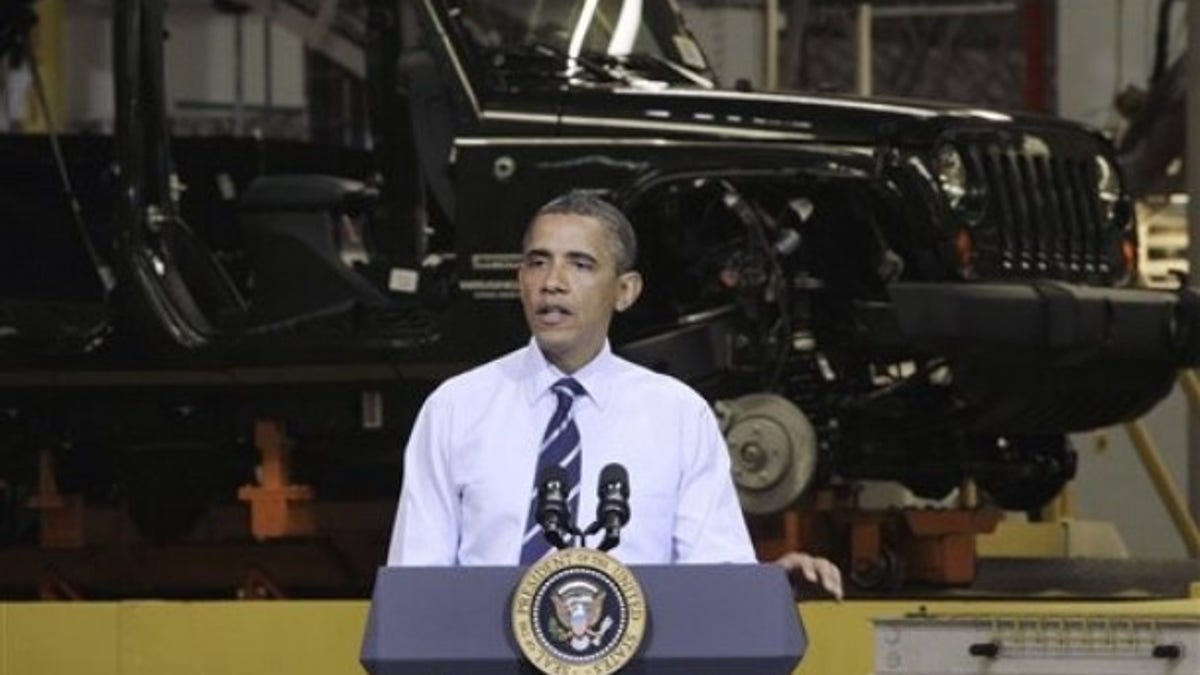

President Obama speaks at Chrysler Group's Toledo Assembly complex in front of a Jeep Wrangler, Friday, June 3, 2011, in Toledo, Ohio.

The U.S government has sold its shares in Chrysler LLC at a likely loss of $1.3 billion in taxpayer money, the Treasury Department said Thursday, announcing the end of a controversial investment that resurrected the troubled auto company.

Italian automaker Fiat SpA, which has run the company since it emerged from bankruptcy protection in June 2009, purchased the U.S. government's remaining 98,000 shares in the auto company for $560 million.

The financial loss irritated Republican lawmakers.

"I am deeply disturbed to learn that the Obama administration left $1.3 billion taxpayer dollars on the table in resolving its bailout of Chrysler," said Rep. Darrell Issa, R-Calif., chairman of the House Oversight and Government Reform Committee.

"The administration has sold out an American icon to a foreign company using TARP funds underwritten by taxpayers. Now they are essentially give that same company $1.3 billion of taxpayer money," he said.

"At a time when American taxpayers must make tough choices to repay their mortgages -- even on houses worth less than they paid -- it is unfathomable that Italian automaker Fiat and its subsidiary Chrysler got away with repaying less than the full amount borrowed from the U.S. government," he added.

Treasury provided a total of $12.5 billion to Chrysler and its financing arm after the recession hampered auto sales and sent Chrysler and General Motors to the brink of collapse. The funds came from the government's $700 billion bank bailout fund.

Since then, $11.2 billion of the assistance has been repaid, Treasury said. Chrysler repaid $5.1 billion in loans from the government in May. But the $1.3 billion remaining is unlikely to be recovered, Treasury said.

"With today's closing, the U.S. government has exited its investment in Chrysler at least six years earlier than expected," said Tim Massad, assistant secretary for financial stability.

"This is a major accomplishment and further evidence of the success of the administration's actions to assist the U.S. auto industry, which helped save a million jobs during the worst economic crisis since the Great Depression."

Chrysler has made a remarkable turnaround from two years ago, when it was rescued by the government.

The company earned net income of $116 million in the first quarter and is forecasting 2011 earnings of $200 million to $500 million. Under the leadership of Fiat CEO Sergio Marchionne, the company has cut costs and revived its sales by refurbishing most of its lineup of Jeep, Chrysler, Dodge and Ram vehicles.

Its sales rose 30 percent in June compared to the previous year.

The purchase of the government's stake gives Fiat 52 percent ownership of Chrysler. That's likely to rise to 57 percent before the end of the year when Chrysler begins producing a 40 mpg small car in the U.S.

Fiat received a 20 percent stake in Chrysler after the bankruptcy in exchange for management expertise and technology. The Italian automaker has gradually raised its stake by meeting benchmarks set by the government.

The Associated Press contributed to this report.