April 17, 2024

The last thing Democrats want is a ‘full trial’ for Mayorkas

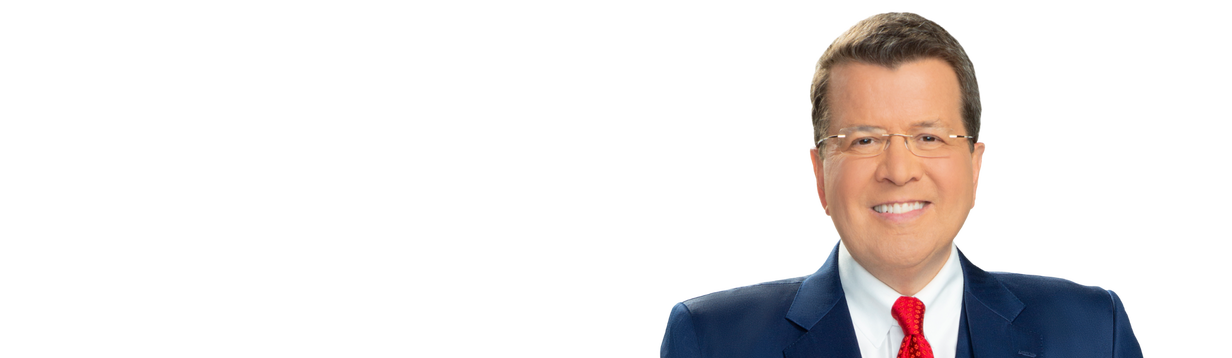

Rep. Chip Roy, R-Texas, discusses DHS Secretary Alejandro Mayorkas' impeachment trial in the Senate on ‘Your World.’

Rep. Chip Roy, R-Texas, discusses DHS Secretary Alejandro Mayorkas' impeachment trial in the Senate on ‘Your World.’