April 25, 2024

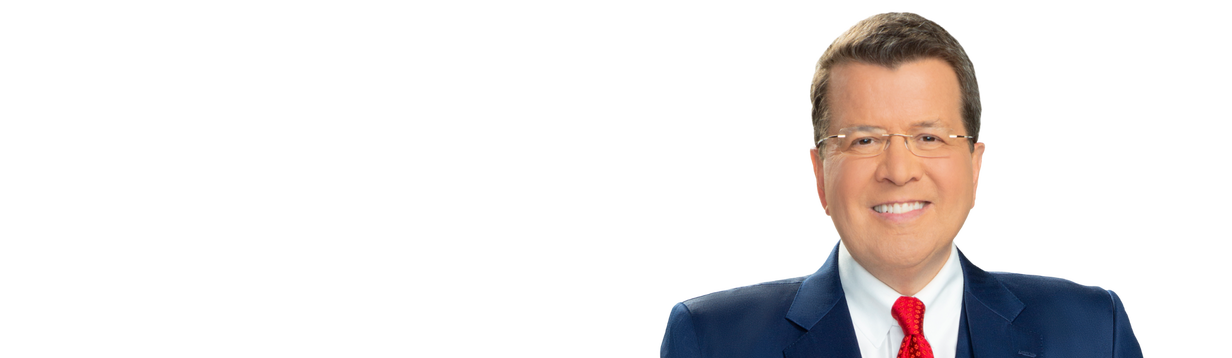

Trump: 'A president has to have immunity'

Former President Trump discussed the third day of testimony in Manhattan DA Alvin Bragg's case and the 'monumental' hearing on presidential immunity at the Supreme Court Thursday.

Former President Trump discussed the third day of testimony in Manhattan DA Alvin Bragg's case and the 'monumental' hearing on presidential immunity at the Supreme Court Thursday.