April 25, 2024

Trump had an 'incredibly successful day' at the Supreme Court: John Yoo

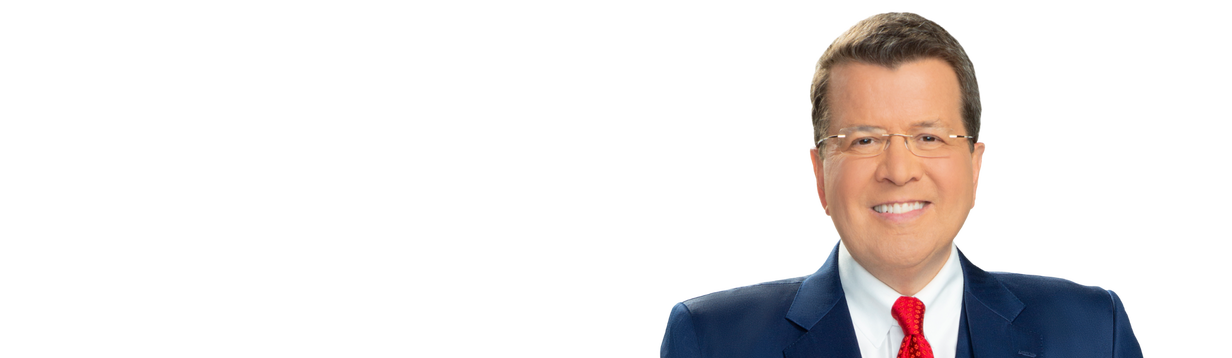

UC Berkeley Law professor John Yoo discusses the third day of testimony in NY v. Trump and the Supreme Court hearing arguments about presidential immunity on 'Your World.'